Definition Of Debt Yield

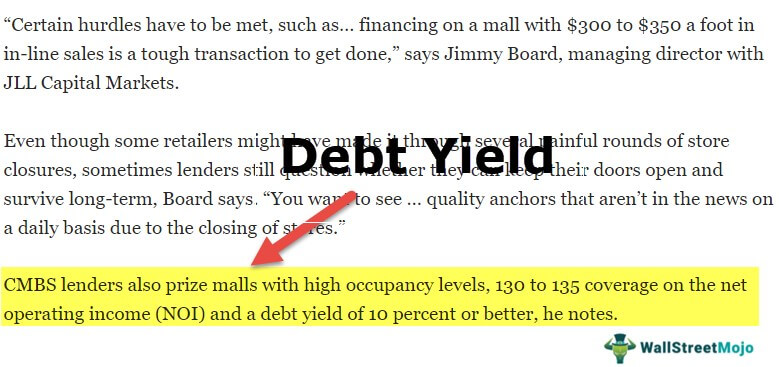

A borrower seeking a loan with an insufficient DYR will fail underwriting even with acceptable LTV and DSCR numbers. Debt yield is one of the most important risk metrics for commercial and multifamily loans and can be determined by taking a propertys net operating income NOI and dividing it by the total loan amount.

Leveraged Finance Meaning Effects And More Finance Meaning Finance Accounting And Finance

What is a way to think of what this means.

Definition of debt yield. Debt yield is a risk measure for mortgage lenders and measures how much a lender can recoup their funds in the case of default from its owner. The debt service coverage ratio and the loan-to-value ratio. The transaction will have a Debt Yield Ratio of 833.

Alternatively it is possible to use the equation to back into the loan amount that can be achieved when a specific debt yield is required. However in todays low interest rate and compressed cap rate environment lenders will continue to gravitate toward and put more importance on debt yield to assess their risk and relative basiss. Debt Yield means Adjusted Net Cash Flow divided by the sum of a the unpaid principal amount of the Mortgage Loan and b the outstanding principal balance of any subordinate or mezzanine financing including without limitation the Loan and any other mezzanine loan which constitutes a portion of the Mez Loan then affecting or related to the Property or any interest therein determined as of the date of.

For example lets say that a commercial property has a NOI of 437000 per year and some conduit lender has been asked to make a. For example if a propertys net operating income is 100000 and the total loan amount is 1000000 then the debt yield would simply be 100000. The Debt Yield Ratio is calculated by taking the NOI and dividing it into the first mortgage debt balance.

Debt yield is a static ratio that doesnt vary with variables such as interest rate amortization period or cap rate. The Debt Yield Ratio is defined as the Net Operating Income NOI divided by the first mortgage debt loan amount times 100. Debt yield provides lenders with a tool that removes subjectivity and helps lenders navigate an inflated market.

For example lets say that a propertys NOI is 100000 and the total loan is for 1000000. In this video on Debt Yield Ratio here we discuss the definition of debt yield ratio along with its formula and practical example𝐖𝐡𝐚𝐭 𝐢𝐬 𝐃𝐞𝐛𝐭 𝐘. The ratio evaluates the percentage return a lender can receive if the owner defaults on the loan and the lender decide to dispose of the mortgaged property.

Debt Yield means Adjusted Net Cash Flow divided by the sum of a the unpaid principal amount of the Mortgage Loan and b the outstanding principal balance of any subordinate or mezzanine financing including without limitation the Loan and any other mezzanine loan which constitutes a portion of the Mez Loan then commercial real estate debt funds. You get the debt yield by dividing 100000 by 1000000 which gives you a debt yield of 10. Debt Yield Net Operating Income Loan Amount.

Debt Yield in Relation to Multifamily Loans. As an example lets say you have an office building with a NOI of 500000 and the borrower wants to finance a loan of 6000000 on it. Minimum Debt Yield means i prior to the first 1st anniversary of the Closing Date 9 ii from the first 1st anniversary of the Closing Date but prior to the second 2nd anniversary of the Closing Date 10 iii during the First Extension Term 11 iv during the Second Extension Term 12 and v during the Third Extension Term 13.

Therefore debt yield provides an objective measure of loan risk. Debt yield is defined as a propertys net operating income divided by the total loan amount. The debt yield calculates the risk associated with a commercial real estate mortgage by dividing the net operating income of the property by the loan amount.

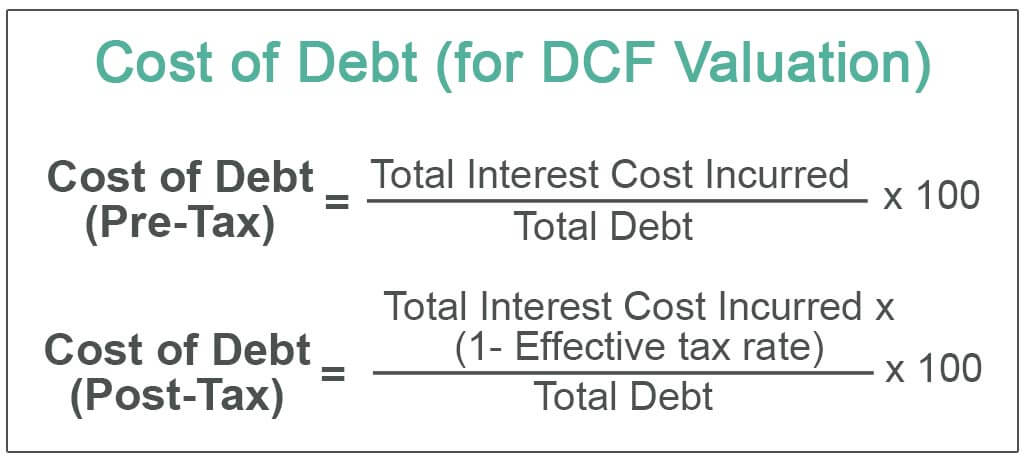

Debt yield refers to the rate of return an investor can expect to earn if heshe holds a debt instrument until maturity. Risk Tests for Commercial Loans Most banks apply two tests to assess the risk associated with a commercial real estate loan. Heres the formula for debt yield.

How can we calculate Yield on Debt. Lenders will continue to utilize LTV and DSCR. Lenders use debt yield to understand how long it would take for them to recoup their investment if they had to take possession of a property after a.

For example lets say that a commercial property has a NOI of 437000 per year and some conduit lender has been asked to make a new first mortgage loan in the amount of 6000000. The Debt Yield Ratio is defined as the Net Operating Income NOI divided by the first mortgage debt loan amount times 100.

Leveraged Finance Meaning Effects And More Finance Meaning Finance Accounting And Finance

How To Calculate The Debt Yield

Yield Curve What It Is And Why It Is So Important Yield Curve Finance Investing Accounting And Finance

Capital Structure Analysis Structural Analysis Financial Analysis Analysis

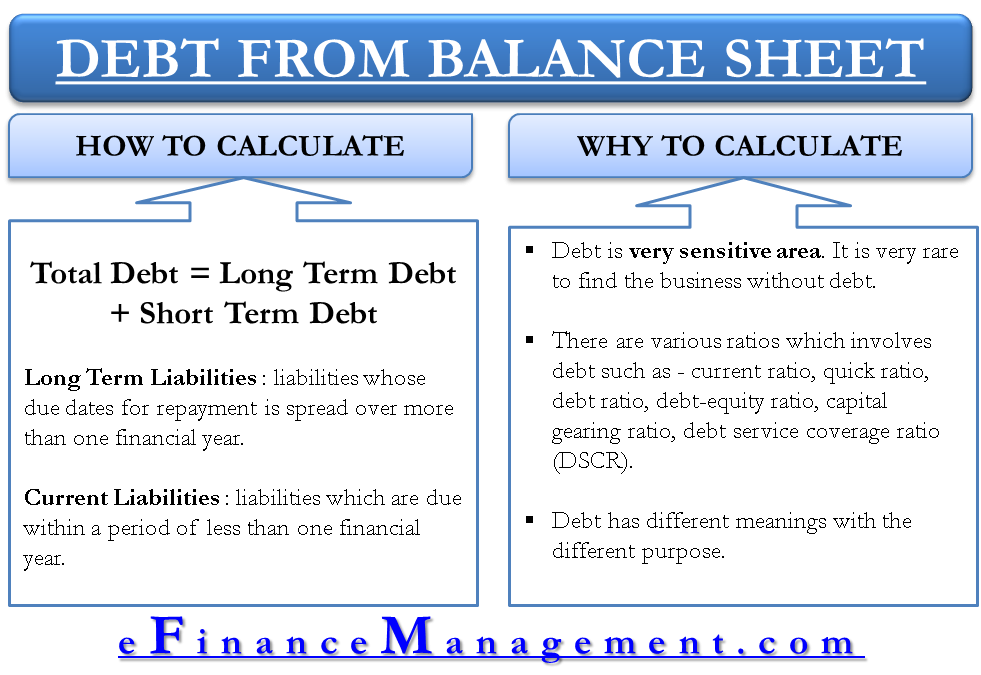

How To Calculate Total Debt From Balance Sheet Efinancemanagement

My Favorite Checking Account I Will Teach You To Be Rich Best Savings Account Personal Finance How To Get Rich

Debt Yield Definition Formula Calculate Debt Yield Ratio

What Are Accounting Ratios Definition And Examples Market Business News Accounting And Finance Bookkeeping Business Learn Accounting

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

Annual Percentage Yield Apy Is A Financial Definition You Need To Know You Can Make Your Money Wo Debt Relief Programs Smart Finances Certificate Of Deposit

Understanding Calculating Debt Yield Visio Lending

Cash Sweep Helps You Pay Debt Or Earn Higher Interest Cash Management Cash Sweep Accounting And Finance

Important Banking Terms Commercial Papers Banking Awareness Rbi Ibps Accounting And Finance Banking General Knowledge

Calculate Debt Yield In Real Estate Argus Cre News And Insights

Relevant Costs Accounting And Finance Accounting Basics Accounting Classes

Bond Market Meaning Types Strategies Bond Indices And More Finance Investing Accounting And Finance Marketing Strategy Business

How To Calculate The Debt Yield

Calculate Debt Yield In Real Estate Argus Cre News And Insights

Post a Comment for "Definition Of Debt Yield"