Definition Of Family Coverage For Hsa

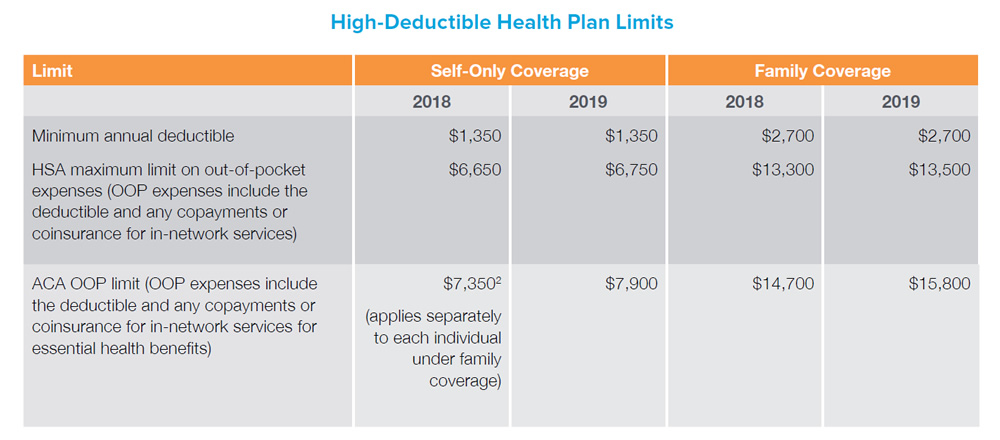

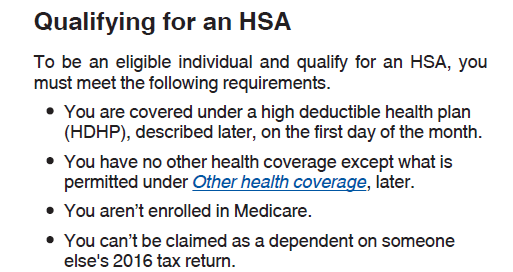

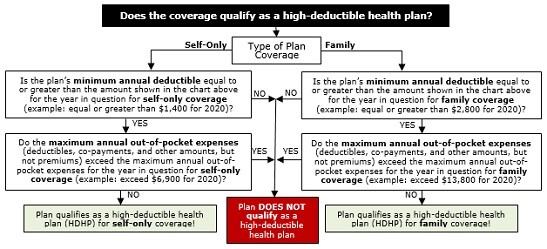

There is a special contribution limit for married individuals which provides that if either spouse has family HDHP coverage then both spouses are treated as having only that family coverage. For 2021 the IRS defines a high deductible health plan as any plan with a deductible of at least 1400 for an individual or 2800 for a family.

Hras Vs Hsas What Is The Difference Aflac

The statutory limit for HSA contributions is subject to potential annual cost-of-living adjustments COLAs.

Definition of family coverage for hsa. In this case each parent can use their HSAs to pay for qualified medical expenses for the child even if the other parent claims the child as a dependent. Individuals who turn age 55 or older before the end of the tax year are eligible for an additional 1000 catch-up. Typically a Social Security number of one individual.

Family coverage is any coverage other than self-only coverage eg an HDHP covering one eligible individual and at least one other individual whether or not the other individual is. You should answer that each of you has family coverage. A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses.

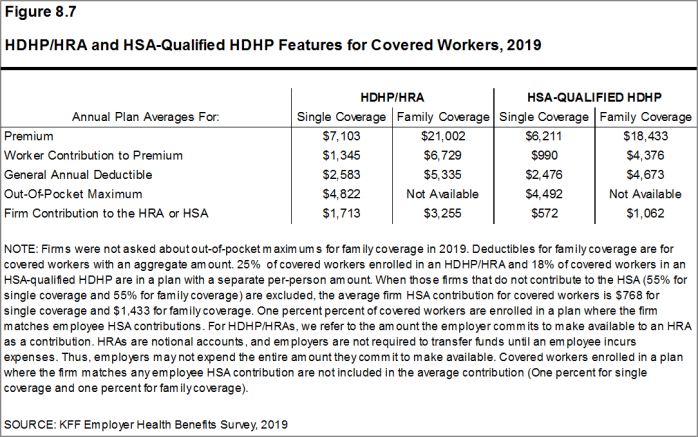

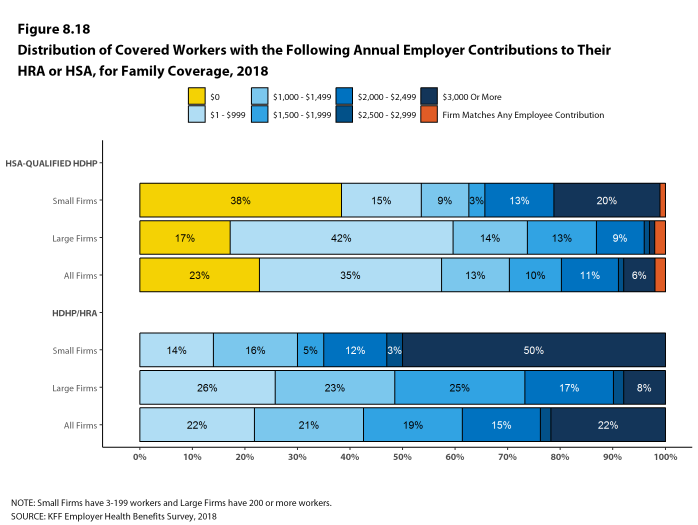

But family coverage under a qualifying HDHP allows you to use your HSA to pay for qualifying medical expenses for yourself and your family. Contribution limits for 2020 are 3550 if your HDHP covers just yourself and 7100 if it covers at least one other family member increasing to 3600 and 7200 in 2021. For an HSA established on behalf of an employee both the employee and the employer may make contributions.

An HSA may receive contributions from an eligible individual or any other person including an employer or a family member on behalf of an eligible individual. There is a special rule for a married couple who both have coverage in a High Deductible Health Plan HDHP. This means that if both spouses are HSA-eligible and either has family HDHP coverage the spouses combined contribution limit is the annual maximum limit for individuals with family HDHP coverage.

For purposes of qualifying medical expenses under some circumstances a child of divorced or separated parents can be treated as a dependent of both parents. In the real world though many families dont follow the once-common pattern of husband wife and children. As a result the legislation and subsequent interpretation by the Internal Revenue Service IRS have created some restrictions and some opportunities for non-traditional families.

Additionally family members may make contributions on behalf of other family members as long as the other family member is an eligible individual ie has a qualified HDHP and is not otherwise insured. Although the individual may have family coverage under a high deductible health plan HDHP and assets in an HSA can be used to pay. 5 Archer MSA The term Archer MSA has the meaning given such term in section 220 d.

How do I fund my HSA. Regardless of whether you have insurance coverage. Like an IRA an HSA is an individual account and must be established in the name and tax identification number TIN.

There is no such thing as a family or joint health savings account HSA. Contributions other than employer contributions are deductible on the eligible individuals return whether or. Each HSA is owned by one person.

D Health savings account For purposes of this section. A Health Savings Account HSA is a tax-advantaged savings account that is created for people who get their insurance coverage through high-deductible health plans. If one of you has family coverage then your spouse is also treated as having family coverage for the purpose of determining your contribution limit.

Use an HSA to save money on dental care eye exams eyeglasses and more. HSA funds generally may not be used to pay premiums. 10 Eligible Expenses for HSAs.

The Health Savings Account HSA legislation was written in 2003 with traditional families in mind. The term family coverage means any coverage other than self-only coverage. An HSA is a tax-deductible savings account used in conjunction with an HSA-qualified high-deductible health plan.

An HDHPs total yearly out-of-pocket expenses including deductibles copayments and coinsurance cant be more than 7000 for an individual or 14000 for a family. The type of health plan individual or family youre enrolled in decides how much you can contribute to your HSA account in one calendar year. 2 2021 at 1139 am.

By using untaxed dollars in a Health Savings Account HSA to pay for deductibles copayments coinsurance and some other expenses you may be able to lower your overall health care costs. The maximum annual health savings account HSA contribution for family high deductible health plan HDHP coverage is 7000 for 2019 and 7100 for 2020.

Health Savings Accounts What You Need To Know Brinson Benefits Employee Benefits Advisory And Patient Advocacy Firm

Section 8 High Deductible Health Plans With Savings Option 9335 Kff

If You V Never Considered Using An Hsa For Your Health Insurance Here Are 5 Really Good Reasons Why Yo Health Savings Account Savings Account Money Management

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Hsas Prorating Contributions Ascensus

How Hsa Contribution Limits Work For Spouses

Hsa Contribution Limits What To Watch Out For When Families Have Multiple Accounts

Family Hsa Vs Individual What S The Difference Lively

Hsa Family Contribution Limit Spouse On Medicare Hsa Edge

Family Hsa Vs Individual What S The Difference Lively

Health Insurance A Visual Glossary Infographic Health Insurance Quote Infographic Health Health Insurance

How To Get Health Insurance On The New York State Exchange What To Consider Where To Look How To Do It Done Family Income How To Get Health Insurance

Hdhp Family Coverage And The Hsa Contribution Limit Ascensus

What You Need To Know About Health Savings Accounts Brady Martz Associates

Section 8 High Deductible Health Plans With Savings Option 9240 Kff

Tools For Financial Stability Financial Financial Stability Financial Decisions

Can You Use Your Hsa For Someone Else Hsastore

Pin By Investopedia Blog On Finance Terms Payroll Taxes High Deductible Health Plan Health Savings Account

Are Health Insurance Premiums Tax Deductible You Know You Can Deduct Some Medical Expenses From Y In 2020 Insurance Deductible Medical Insurance Health Insurance

Post a Comment for "Definition Of Family Coverage For Hsa"