Definition Of Variable Annuity

The contract provides the holder with future payments based on the performance of the contracts underlying securities. It is designed to provide retirement income.

What Does Valic Mean Definition Of Valic Valic Stands For Variable Annuity Life Insurance Company By Acronymsandslang Com

Their sales are regulated both by FINRA and the Securities and Exchange Commission SEC.

/shutterstock_406789141.annuity.TypoArtBS-53a59b66a8e64b2f8c956415e53735e5.jpg)

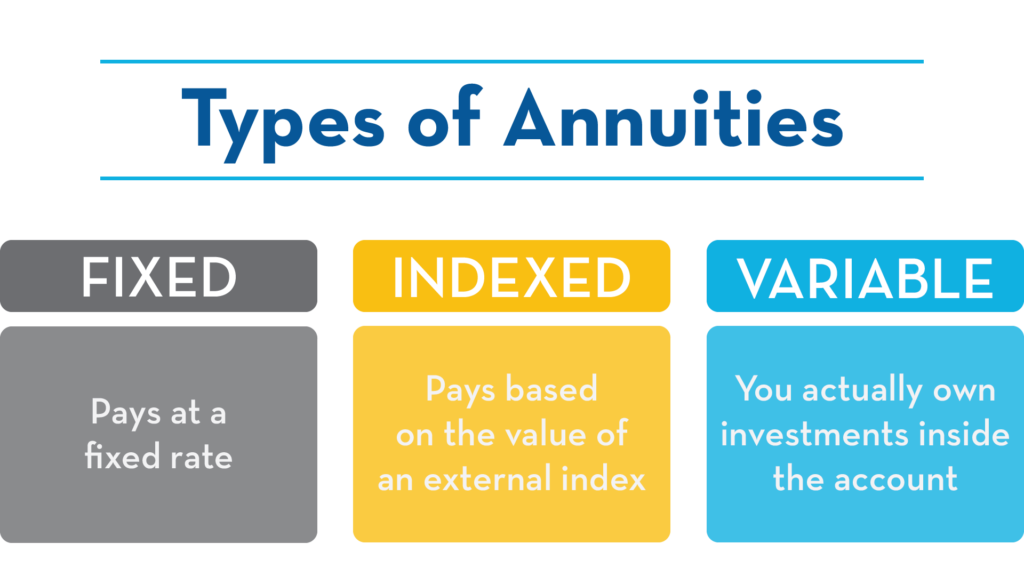

Definition of variable annuity. One investment option is a variable account which typically consists of equity bond or money market mutual funds. Variable annuity in American English noun an annuity in which the premiums are invested chiefly in common stocks or other securities the annuitant receiving payments based on. The tax-deferred return on your variable annuity fluctuates with the performance of the underlying investments in your separate account.

A variable annuity is an insurance company product designed to allow you to accumulate retirement savings. In accounting the term annuity refers to a sum of money paid annually by a borrower in order to repay his debt. It serves as an investment account that may grow on a tax-deferred basis and includes certain insurance features such as the ability to turn your account into a stream of periodic payments.

An annuity in which payments to the annuitant vary according to the changing market value of the underlying investment. Unlike fixed and equity indexed annuities variable annuities do not guarantee your principal investment interest or. A new category of deferred annuity called the fixed indexed annuity FIA emerged in 1995 originally called an Equity-Indexed Annuity.

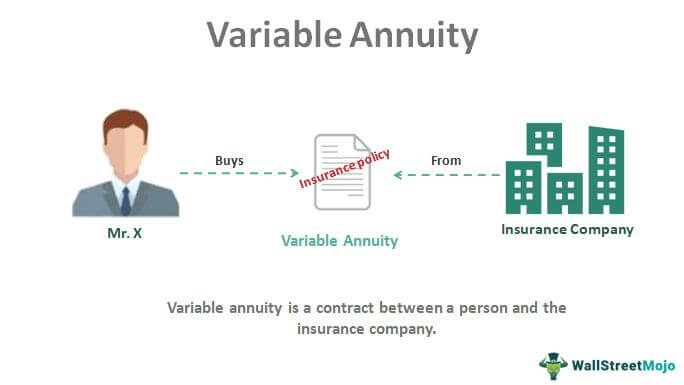

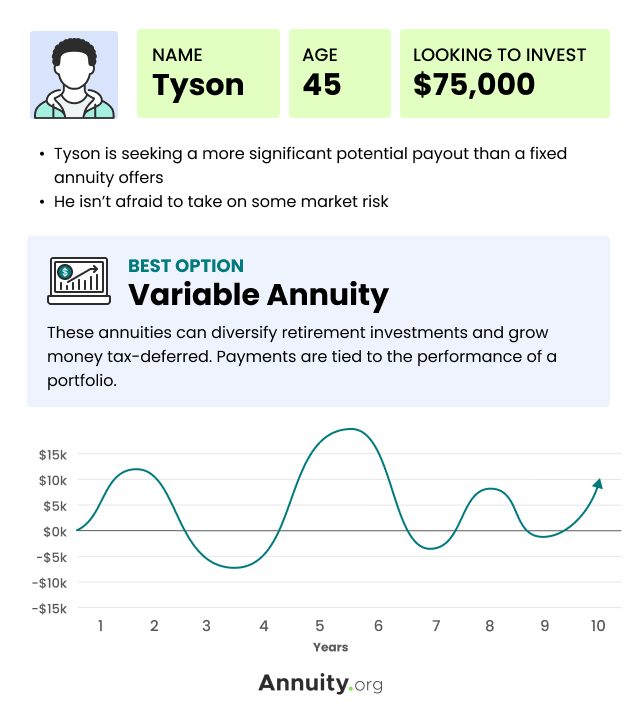

Variable annuities are not suitable for short-term financial goals. A variable annuity is a contract between you and an insurance company. The insurer guarantees a minimum payment but the rate of return on the underlying securities may vary.

An annuity in which payments to the annuitant vary according to the changing market value of the underlying investment. Deferred variable annuities are hybrid investments containing securities and insurance features. Variable annuities - make payments to an annuitant varying in amount for a definite length of time or for life.

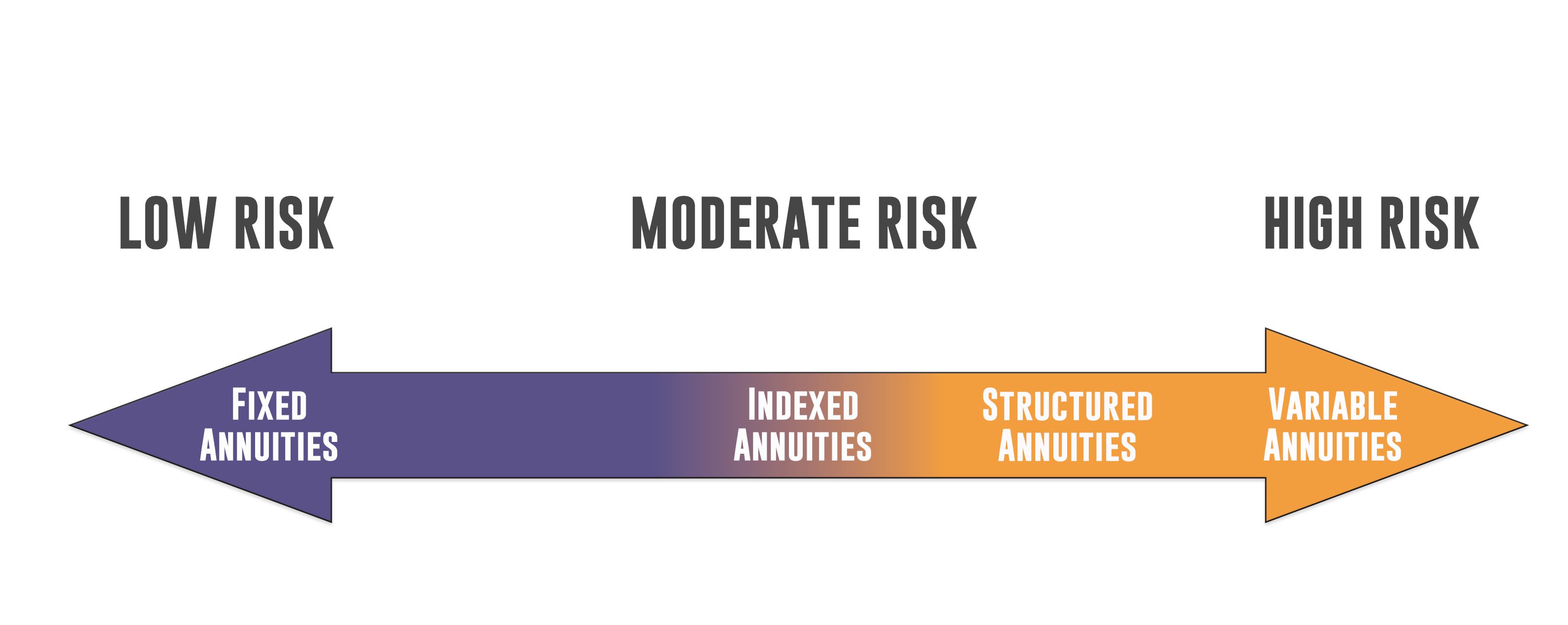

In accounting the term annuity refers to a sum of money paid annually by a borrower in order to repay his debt. Variable Annuity An annuity that provides the annuitant a small guaranteed return for the life of the annuity along with another return that depends on the performance of a portfolio. Variable annuities can provide great returns but theyre the riskiest type of annuity contract you can buy.

This is because while fixed annuities pay interest similar to certificates of deposit variable annuities include participation in both the stock and bond markets. A variable annuity is a type of annuity whose value is tied to the performance of an investment portfolio. A variable annuity is a contract sold by an insurance company.

With a variable annuity the insurance company provides the contract holder with the ability to determine how his or her premiums are invested. These annuities offer investors choices among a number of complex contract features and options. Copyright 2016 by Houghton Mifflin Harcourt Publishing Company.

Payments from variable annuities can increase if the portfolio performs well and decrease if it loses money. American Heritage Dictionary of the English Language Fifth Edition. Still penalties can be incurred for early withdrawals.

A variable annuity is a contract with an insurance company that includes investments you choose and a fixed insurance component. A deferred annuity that permits allocations to stock or bond funds and for which the account value is not guaranteed to stay above the initial amount invested is called a variable annuity VA. The performance of these securities usually mutual funds dictates the size of the eventual annuity payment.

When you purchase a variable annuity either with a lump sum or over time you allocate the premiums you pay among the various separate account funds offered in your annuity contract. Although variable annuities carry the potential of higher returns than fixed annuities they dont offer a guaranteed payout. A variable annuity is an annuity contract offering investors an opportunity to earn higher rates of return on their investments than what they can get with fixed annuities.

Like any annuity the annuitant buys into a policy either with a lump sum or premiums over a period of time. American Heritage Dictionary of the English Language Fifth Edition. The amounts paid may depend on variables such as profits earned by the pension or annuity funds or by cost-of-living indexes.

Annuity Beneficiaries Inherited Annuities Death

Variable Annuity Definition Examples How Does It Work

Annuities For Retirement Maria Gutierrez Insurance

Variable Annuity What Is It Insurance Contracts That Make Payments

Varifund Variable Annuity Account

Recent Variable Annuity Innovations Provide Growth Safety Annuity Fyi

Set Up A Variable Annuity Policy

Annuity Vs Life Insurance Similar Contracts Different Goals

Annuity Contract For Cash Inflows Outflows Example Calculationss

What S Better Than A Paycheck For Life Wink

Variable Annuities Suck Archives Bankers Anonymous

Variable Annuity What Are Variable Annuities How Do They Work

Annuities What Are Buffer Annuities Fidelity

How Annuities Work Examples By Type Considerations

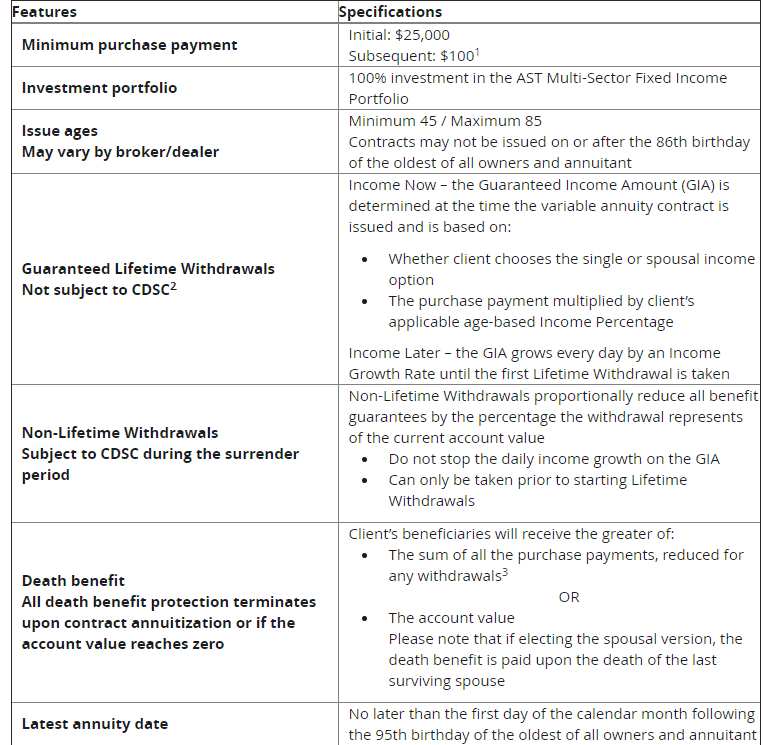

Unbiased Prudential Defined Income Variable Annuity Review

Variable Annuity Definition Example Investinganswers

:max_bytes(150000):strip_icc()/annuity_calculate-5bfc2f6146e0fb00260bd8bd.jpg)

Post a Comment for "Definition Of Variable Annuity"