Definition Work Opportunity Tax Credit

The success and growth of this income tax credit for private-sector businesses depends on a strong public- and private-sector partnership. The work opportunity tax credit is a separate and non-refundable credit.

What S The Work Opportunity Tax Credit Wotc Program Overview Cti

Work Opportunity Tax Credit WOTC--The WOTC allows a credit to eMployers who hire members of certain targeted groups of up to 40 of first-year wages up to 6000 per employee 12000 for qualified veterans.

Definition work opportunity tax credit. The Work Opportunity credit is a federal credit that gives employers a tax break for hiring certain jobseekers. Helping those in need find and retain good jobs and gain on-the-job experience benefits all employers and increases Americas economic growth and. The Work Opportunity Tax Credit Program reduces an employers cost of doing business and requires little paperwork.

Measures such as the RD Tax Credit and Work Opportunity Tax Credit are not expected to be renewed in 2012. An employer must obtain certification that an individual is a targeted group member before the employer may claim the credit. The one-time tax credit is available to for-profit employers hiring individuals in the.

En español The Employment Development Department is the Work Opportunity Tax Credit WOTC certifying agency for California employers. Department of Labor Employment and Training Administration. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire eligible individuals from target groups with significant barriers to employment.

What is the Work Opportunity Tax Credit. Work Opportunity Tax Credit. The Work Opportunity Tax Credit WOTC is authorized until December 31 2025 Section 113 of Division EE of PL.

The work opportunity tax credit WOTC is a federal tax credit thats available to employers who hire individuals from certain targeted groups. The employee groups are those that have had significant barriers to employment. This tax credit incentive was designed to appeal to a wide range of businesses to impose a minimal burden upon participating employers and to promote the hiring of disadvantaged individuals.

The Purpose of the Work Opportunity Tax Credit Target Groups that Qualify for the WOTC. Tax breaks to expire. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment.

The Work Opportunity Tax Credit WOTC program is an income tax credit incentive provided by the Internal Revenue Service and the US. The Work Opportunity Tax Credit was designed specifically to streamline the eligibility. A nonrefundable tax credit can reduce the tax you owe to zero but it cant provide you with a tax refund.

Job vacancies up unemployment dropping but still high unemployment in Whatcom County General business tax credits include the research credit low-income housing credit and the work opportunity credit. The Work Opportunity Tax Credit WOTC refers to a business credit that employers are entitled to when they recruit from certain minority groups known to have specific employment barriers. Each year across the United States employers claim more than 1 billion in tax credits under the WOTC program.

By creating economic opportunities this program also helps lessen the burden on other government assistance programs. The Work Opportunity Tax Credit WOTC is a federal tax credit that encourages employers to hire workers from nine target groups. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment.

116-260 -- Consolidated Appropriations Act. Certification of an individuals targeted group status is obtained from a DLA. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups.

The tax credit is designed to help job seekers gain on-the-job experience move towards economic self-sufficiency and help reduce employers federal tax liability. The Work Opportunity Tax Credit WOTC is a federal tax credit providing incentives to employers for hiring groups facing high rates of unemployment such as veterans youths and others. It was designed as an incentive to employers to hire individuals in certain targeted.

That includes people who have faced significant. Section 51 provides for a Work Opportunity Tax Credit WOTC for employers who hire individuals who are members of targeted groups. The Work Opportunity Tax Credit WOTC is a federal tax credit available to all private sector businesses.

Https Home Treasury Gov System Files 131 Report Aotc 2010 Pdf

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

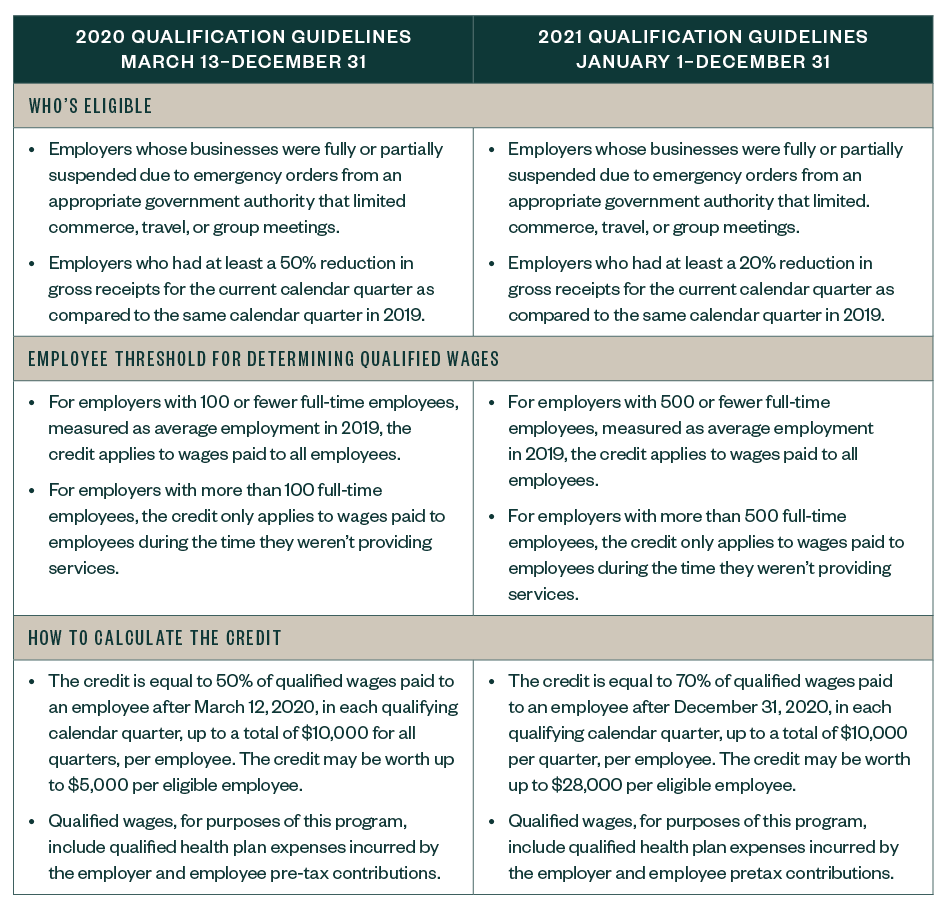

Deadline Extended To Claim The Employee Retention Tax Credit

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-9471446221-5b61bf1746e0fb002c1b89cb.jpg)

How Does The Work Opportunity Tax Credit Work

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

What S The Work Opportunity Tax Credit Wotc Program Overview Cti

:max_bytes(150000):strip_icc()/scissors-with-taxes-word-on-wooden-background-529684030-5c79500446e0fb0001d83d0b.jpg)

How Does The Work Opportunity Tax Credit Work

Deadline Extended To Claim The Employee Retention Tax Credit

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How To Take Advantage Of Education Tax Credits Forbes Advisor

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

Child Tax Credit Definition Taxedu Tax Foundation

Work Opportunity Tax Credit Kansas Department Of Commerce

What S The Work Opportunity Tax Credit Wotc Program Overview Cti

Child Tax Credit Definition Taxedu Tax Foundation

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

Post a Comment for "Definition Work Opportunity Tax Credit"