Definition Of Yield To Call

Yield to call YTC represents the return that one would earn if they held a note or bond until its call date before the debt instrument matures. The lowest possible yieldon a callable bond.

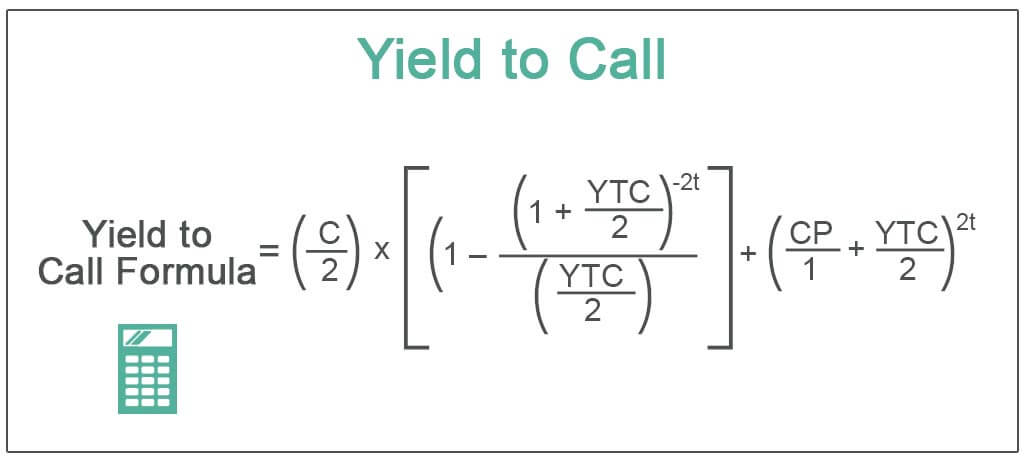

It is the compound interest rate at which the present value of its future coupon payments and call price is equal to the current market price of the bond.

Definition of yield to call. This yield is valid only if the security is called prior to maturity. Yield to maturity and yield to call are both used to estimate the lowest possible pricethe yield to worst. Plural yields to call written abbreviation YTC FINANCE.

If a bond has a call option an investor must consider prepayment and reinvestment risk. If a callable bond is calledbefore maturity the bondholderonly earnsintereston the time that has elapsed between purchasing the bondand its early redemption. The percentage rate of a bond or note if the investor buys and holds the security until the call date.

The total yield profit of a bond etc. In other words its the earnings you would receive if you held a bond until it was called before it matured. The Yield to Call refers to the interest that a bond or note will pay if the investor purchases and holds the instrument until its call date.

Yield To Call Definition. A bond has a purchase price based upon the present value of future interest payments coupons and return of principal at maturity. The yield to call YTC is a calculation of the total return of a bond based off of the purchase price the par value and how much will be received in.

Yield to call is applied to callable bonds which are securities that let bond investors redeem the bonds or the bond issuer to repurchase them early at the call price. T time period when payment is to be received. The simple calculated yield which uses the current trading price and face value of the bond.

Yield to call is calculated on the basis of coupon rate market price and time length to the call. The yield to call is a rate in percentage of a note or bond if after purchase you hold the security till the call date. Yield to Call.

The term yield to call refers to the return a bondholder receives if the security is held until the call date prior to its date of maturity. The converged upon solution for the yield to call of the current bond the internal rate of return assuming the bond is called. Many issuers of bonds particularly corporations will include the option to repurchase or.

If the bond is kept until the call date when it must be paid back when this is earlier than the maturity date the original date on which it was planned to pay it back. The concept of yield to call is something that every fixed-income investor will be aware of. The security should be called before maturity to make the yield valid.

Yield to call is the price that will be paid if the issuer of a callable bond opts to pay it off early. Thus yield to call YTC can be defined as the internal rate of return IRR if a bond is. See the bond yield calculator for explanation.

To calculate the yield to call the investor then uses a financial calculator or software to find out what percentage rate r will make the present value of the bonds cash flows equal to todays selling price. Generally bonds are callable over several years and normally are called at a slight premium. Yield to call is the return on investment for a fixed income holder if the underlying security ie Callable Bond is held until the pre-determined call date and not the maturity date.

Yield to call is a calculation that determines possible yields if a bond can be called by the issuer reducing the amount of money the investor receives because the bond is not held to maturity. The percentage rate of a bond or note if the investor buys and holds the security until the call date. The rate of return to the investor earned from payments of principal and interest with interest compounded semi-annually at the stated yield presuming that the security is redeemed on a specified call date if the security is redeemed at a premium call price the amount of the premium is also reflected in the yield.

Callable bonds generally offer a slightly higher yield to maturity. This yield is valid only if the security is called prior to maturity. In such a scenario the issuer can redeem bonds and reissue them at a lower interest rate.

Yield to call YTC is the rate of return earned on a bond from its valuation date to its call date. Yield to Current Call.

God Where Is My Boaz Quotes About Love And Relationships Trust Yourself God

Pin By C Brown On Success Investing Money Financial Motivation Finances Money

Cenitexservices Website Design As A Rule Includes Many Changed Orders And Aptitudes In The Suppor Web Development Design Design Development Electronic Records

Breath Definition Of Breath By Merriam Webster Breathe Definitions Merriam Webster

The Abc S Of Love Night Quotes Just You And Me Wall Plaques

Hp 12c Bond Yield Calculations Tvmcalcs Com Bond Financial Calculator Electric Power

Yield To Call Definition Formula How To Calculate Yield To Call Ytc

Pin On Genetic Literacy Human Genetics

/GettyImages-502902960-b1593a34a3cc46d2991e89133b9561cf.jpg)

Yield To Maturity Vs Yield To Call The Difference

Microwaving Lemons And Other Fruits For 15 Seconds Will Yield Double The Juice You Would Normally Get From Them Without Microw 1000 Life Hacks Hacks Life Hacks

How To Tell If An Oil Is Top Quality Temperature At Which Steam Distillation Is Carried Out Plays An Important R Distillation Steam Distillation Aromatherapy

:max_bytes(150000):strip_icc()/89882932-5bfc389446e0fb00260eba3c.jpg)

:max_bytes(150000):strip_icc()/simple_bond_math_for_fixed-coupon_corporate_bonds-5bfc35a346e0fb00517dce6d.jpg)

/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

:max_bytes(150000):strip_icc()/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

:max_bytes(150000):strip_icc()/financial-advisor-having-a-meeting-with-clients-1063753064-989c0dd7e0764d399a799b11a6797199.jpg)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "Definition Of Yield To Call"