Equity Definition Home Loan

A home equity loan also known as a home equity installment loan or a second mortgage is a type of consumer debt. Home equity is often an owners greatest asset.

What Is Reverse Mortgage Loan Learn Reverse Mortgage Definition Here

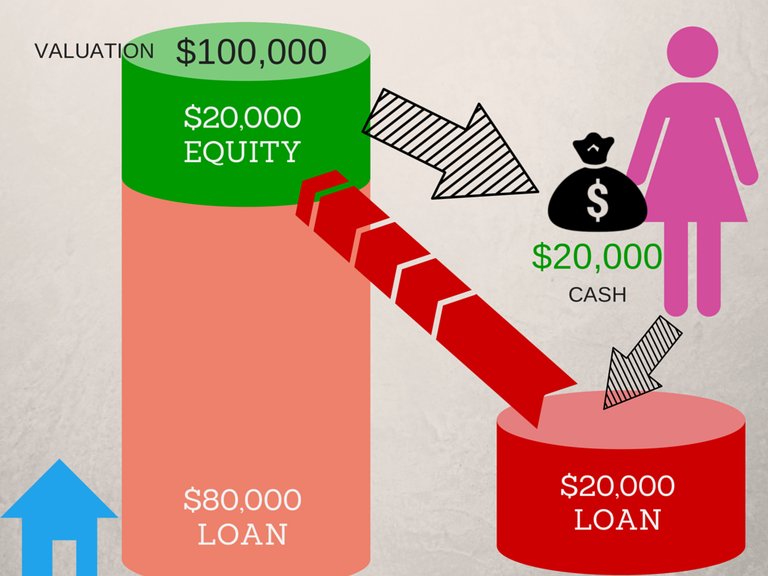

An equity loan is essentially money borrowed against your propertys net worth.

Equity definition home loan. A home equity loan is a fixed-term loan granted by a lender to a borrower based on the equity in their home. Home equity loans can be. It can be used later in life so it pays to know how it works and how to use it wisely.

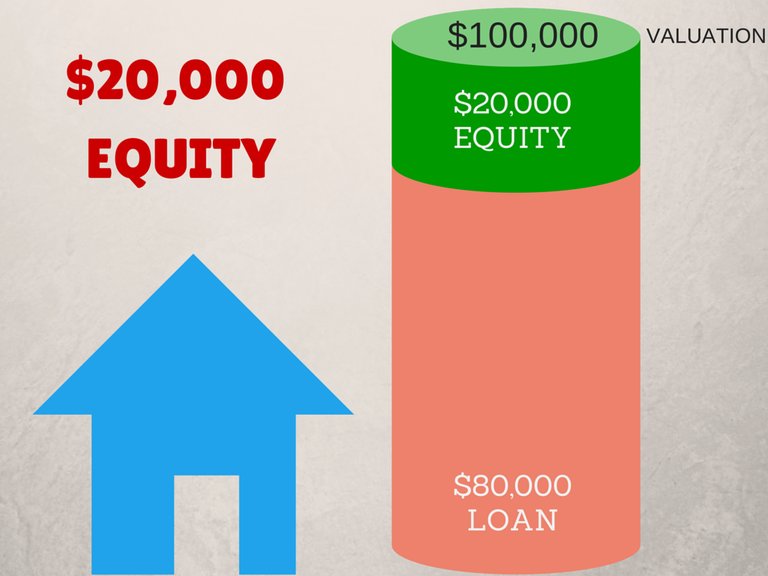

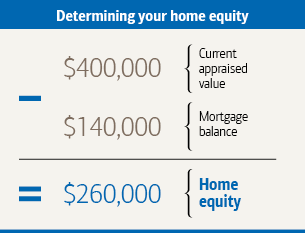

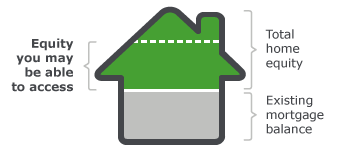

Equity is the difference between what you owe on your mortgage and what your home is currently worth. A home equity loan sometimes called a HEL allows you to borrow money using the equity in your home as collateral. In most cases lenders prefer that you own at least 20 of your home before applying for a home equity loan.

Home equity loans are often referred to as. Home equity loans allow homeowners to borrow against the equity in their. A home equity loan sometimes referred to as a second mortgage usually allows you to borrow a lump sum against your current home equity for a fixed rate over a fixed period of time.

It can be seen as a percentage of the property that you own. Equity is the difference between what your home is worth and what you still owe on the mortgage. A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans 1 such as credit cards.

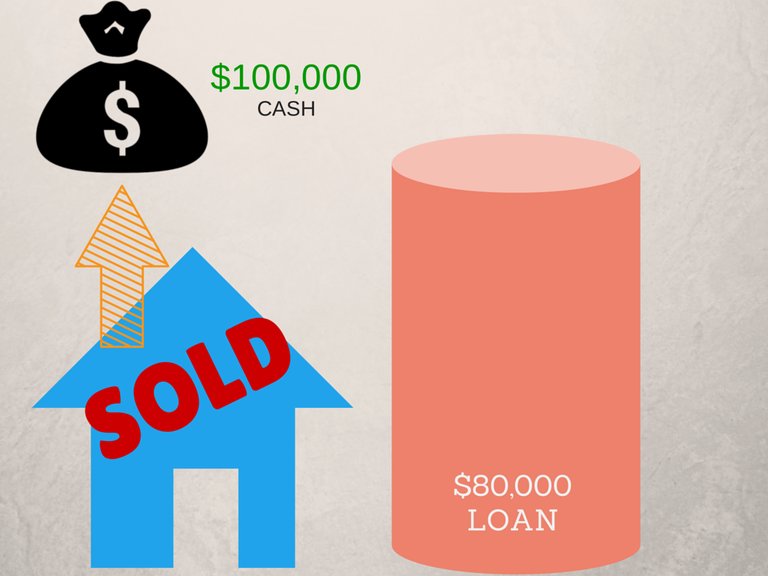

Equity is the amount your property is currently worth minus the amount of any existing mortgage on your property. A home equity loan is a type of loan in which the borrower uses the equity in their home as collateral. Lets say you bought a 250000 house with a down payment of 7 approximately 17500 resulting in a loan amount of 232500.

A home equity loan creates a lien against. You repay the loan with equal monthly payments over a fixed term just like your original mortgage. You then make monthly repayments over the term of the agreement just as you do with your first or primary mortgage.

A home equity loan is a lump sum loan that you pay back in monthly installments over 5 to 15 years. If you owe 150000 on your mortgage loan and your home is worth 200000 you have 50000 of equity in your home. A home equity loan is a type of second mortgage that allows you to borrow against your homes value using your home as collateral.

A home equity loan sometimes called a second mortgage is secured by the equity in your home. A home equity loan is a loan for a fixed amount of money that is secured by your home. It is secured by the equity in your home.

Here are key features of a home equity loan. In the simplest terms your homes equity is the difference between how much your home is worth and how much you owe on your mortgage. Home equity loans are often used to finance major expenses such as home repairs medical bills or college education.

A home-equity loan refers to a type of loan in which a homeowner uses the equity of his home as a collateral for a loan. A home equity loan also known as a second mortgage term loan or equity loan is when a mortgage lender lets a homeowner borrow money against the equity in his or her home. A home equity line of credit HELOC typically allows you to draw against an approved limit and comes with variable interest rates.

A home-equity loan is a consumer debt which is secured by a second mortgage in this type of loan a homeowner borrows against the equity of his home. In a property it is the difference between the current value of your home and the amount you still owe on a mortgage loan. As you pay down your mortgage the amount of equity in your home will rise.

Home equity is the portion of your property that you truly own Your lender has an interest in the property until you pay off your mortgage although youre still considered to be the homeowner. You receive the loan principal minus fees for arranging the loan in a lump sum. Taking on a new loan does decrease your equity so if you were to sell before paying down the loans your portion of funds from a sale are reduced.

Your equity can increase in two ways. If you dont repay the loan as agreed your lender can foreclose on your home. Look at this example.

A loan based on the amount of equity a person has in his or her home Learn More About home equity loan Share home equity loan Dictionary Entries Near home equity loan.

/house-5bfc4743c9e77c0051a0f19e.jpg)

Mortgage Refinancing When Does It Make Sense

How To Calculate Your Home S Equity Loan To Value Ltv Tips

How Does Equity Work The Dummies Guide To Equity

How Does Equity Work The Dummies Guide To Equity

Home Equity Loans Vs Home Equity Lines Of Credit Mid Hudson Valley Federal Credit Union

How To Calculate Your Home S Equity Loan To Value Ltv Tips

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-494330523-5a43dc60eb4d520037842ffc.jpg)

Home Equity Loans The Pros And Cons And How To Get One

The Truth About Down Payment And Equity Filipino Homes Official Blog

Equity Maturing Home Equity Account Wells Fargo

How Does Equity Work The Dummies Guide To Equity

Predatory Lending Laws Unfair Credit Practices

What Is A Home Equity Line Of Credit Heloc And What Can It Be Used For

How To Get Equity From Your Home Youtube

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

Home Equity Loans The Pros And Cons And How To Get One

Gift Of Equity Mortgage Guidelines When Buying Home At Discount

Home Equity And Heloc Loans Complete Guide

/business-with-customer-after-contract-signature-of-buying-house-957745706-85fbb1739bcc4a27b1e5d1e80dd9c1c9.jpg)

:max_bytes(150000):strip_icc()/home_loans_istock519111203-5bfc331ec9e77c002631cac7.jpg)

Post a Comment for "Equity Definition Home Loan"