Definition Of Single Residential Unit Under Gst

122017 Services by way of pure labour contracts of construction erection commissioning or installation of original works pertaining to a single residential unit otherwise than as a part of a residential complex -- Exempt. A duplex is generally considered to be a multiple unit residential complex but as noted in paragraph 48 a duplex is considered a single unit residential complex for purposes of GSTHST new housing rebates.

Section 195-1 of the GST Act clarifies what is meant by residential premises.

Definition of single residential unit under gst. Residential projects with up to 15 commercial space are treated as residential properties under GST. A residential property includes houses units flats and more. If a builder constructs or substantially renovates a residential complex that is.

That section provides that the term residential premises refers to any land or building that. Sale of a single unit residential complex or a residential condominium unit which previously formed part of a multiple unit residential complex. For the purposes of the GSTHST new housing rebate and the GSTHST new residential rental property rebate a duplex is a single unit residential.

Construction of a Complex Building Civil Structure or a part thereof including a complex or Building intended for sale to a buyer wholly or partly except where the entire consideration has been received after issuance of completion certificate where required by the competent authority or after its first occupation whichever is earlier. It doesnt include vacant land. MEGA EXEMPTION FOR CONSTRUCTION OF SINGLE RESIDENTIAL UNIT.

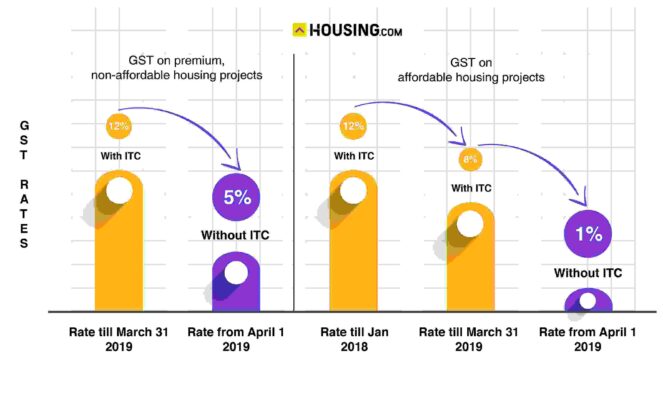

Affordable residential apartment is a residential apartment in a project which commences on or after 01-04-2019 or in an ongoing project in respect of which the promoter has opted for new rate of 1 effective from 01-04-2019 having carpet area upto 60 square meter in metropolitan cities and 90 square meter in cities or towns other than metropolitan cities and the gross amount charged for. 1 If in a single survey no. As a social incentive measure the Government has granted exemption from service tax in respect of services by way construction of a single residential unit if it is designed for residential purposes of one family.

This includes a single-family house that has a separate apartment for rent. A multiple-unit residential complex and subsequently supplies. Yfinal consumer for construction of a house in a land owned by Mr.

The subject transaction will be taxable under the GST laws. B a single residential unit otherwise than as a part of a residential complex. It refers to residential property that provides shelter and contains basic living facilities.

You do not have to pay any GST on the purchase of plots. GST on construction of residential building - single units. Services of construction erection commissioning or installation of original works pertaining to a single residential unitotherwise than as a part of a residential complex Entry 11.

A single-unit residential complex a residential condominium unit or. Contract price is fixed at square feet basis. 2 different building are constructed ie.

5 for residential and. Sale of a previously occupied condominium unit or single unit residential complex by a builder subsequent to a self-supply. By a single entity then what will be the rate of GST charged for the project.

The Works Contracts has been defined in Section 2119 of the CGST. For the purposes of the GSTHST new housing rebate a condominium is not a duplex. MrX Contractor enters into agreement with Mr.

A single residential unit 9954 NIL GST Handbook for Real Estate Transactions VENU AND VINAY 4 P a g e. But I have some queries. For the discussions on Taxability Place of Supply Time of Supply Input Tax redit.

Whether inputtax can be claimed under contract. The single-unit residential complex the residential condominium unit or. Hence supply mentioned by you is exempt as per above notification.

The effective GST on commercial property is 12. You do not have to pay any GST on buying a flat that is ready-to-move-in. Hello the scenario is as follows- a.

The most common example is an apartment building. Is occupied as a residence or for residential accommodation. Dear Veena Ji As per Notification No.

Position under GST Under GST laws the definition of Works Contract has been restricted to any work undertaken for an Immovable Property unlike the existing VAT and Service Tax provisions where works contracts for movable properties were also considered. What will be GST Rate for construction of Single Residence Unit through contract and. Food clothing and shelter are the basic necessities of human life.

A residential unit in the multiple-unit residential complex. One is residential flat another is commercial complex under a single GST reg. A rental of a residential complex or a residential unit in a residential complex is exempt if the complex or unit is to be used by an individual as a place of residence or lodging and if the rental period is a period of continuous occupancy or right of occupancy of one month or more to.

Construction Services Under Gst

Is Gst Applicable On Flats Booked Before The Introduction Of Gst Housing News

Standard Two Bedroom Layout Economical Durable Tiny Living Solution 40 Container House Plans Shipping Container Buildings Shipping Container House Plans

Glamorous Contemporary Outdoor Living Room With Stacked Stone Fireplace Ivory Travertine Outdoor Living Room Decor Living Room Decor Fireplace Outdoor Living

Http Publications Gc Ca Collections Collection 2017 Arc Cra Rv3 1 19 3 7 1998 Eng Pdf

Habitable Sheds Sheds You Can Live In Architectural Design Shed Floor Plans Shed How To Plan

Gst On Real Estate 2021 1 Affordable Housing 5 Under Construction

Mens Cross Pocket Jeans Wholesale Rs 530 00 Per Piece Comfort Fit Jeans Jeans Wholesale Printed Denim Jeans

Want To Invest In Real Estate Beware Of These Gst Myths The New Indian Express

Pin By Harishinfra On Elevation Designs Small House Front Design House Front Design House Outer Design

Revised Gst Rates On Real Estate Properties Latest Gst Rates 2019

S40 Container House Plans Building A Container Home Container House Interior

Gst On Real Estate 2021 1 Affordable Housing 5 Under Construction

Construction Of Residential Rentals And Gst Hst And Qst Audit Issues

Http Www Ryan Com Contentassets 71cf44db93644eb6816808af22f0051a Gi 083 Pdf

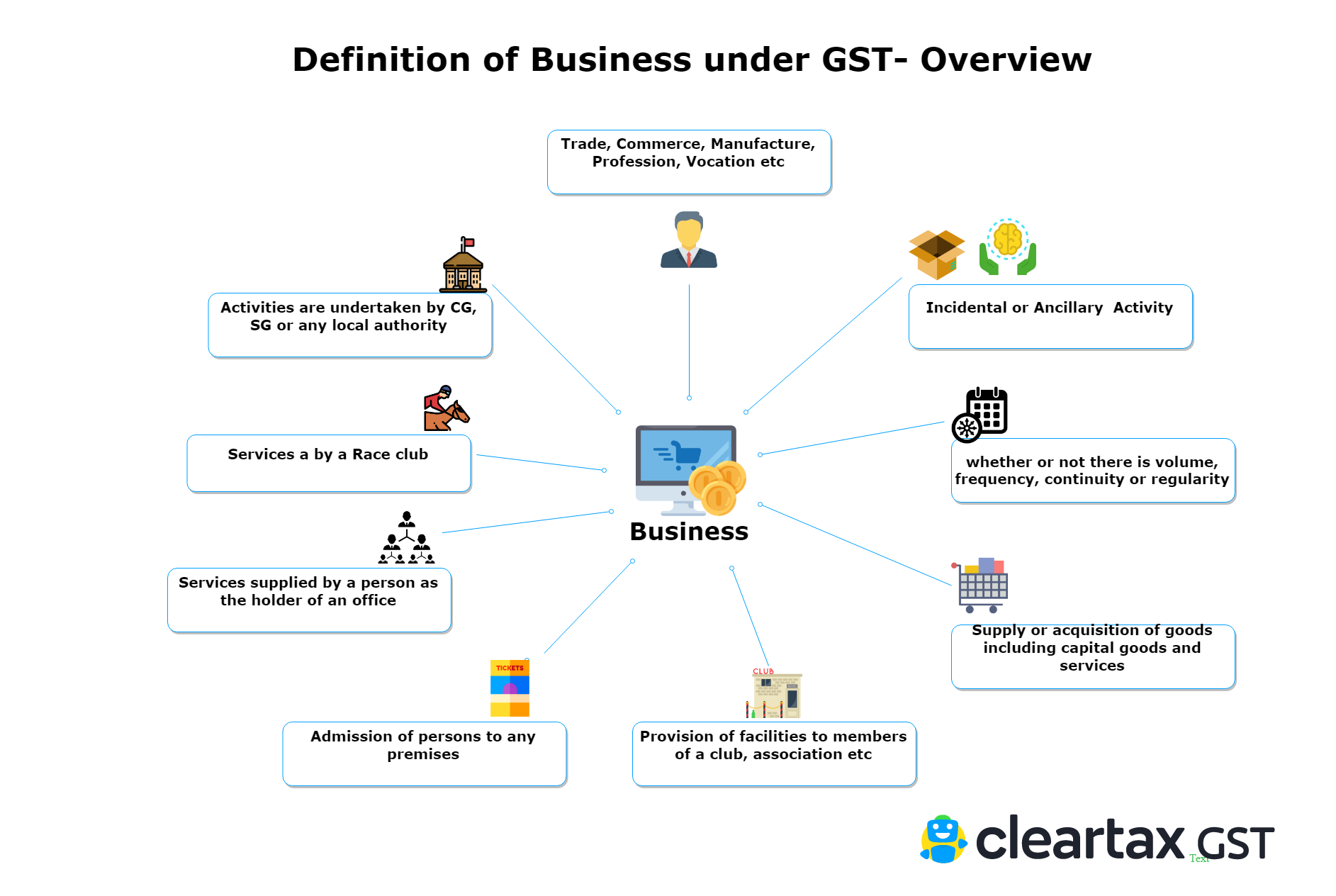

Business Under Gst Overview Meaning Examples

Gst On Real Estate 2021 1 Affordable Housing 5 Under Construction

What Is Affordable Housing As Per Gst Explained

Gst Tariff For Construction Of Residential Complex Service

Post a Comment for "Definition Of Single Residential Unit Under Gst"