Definition Government Monetary Policy

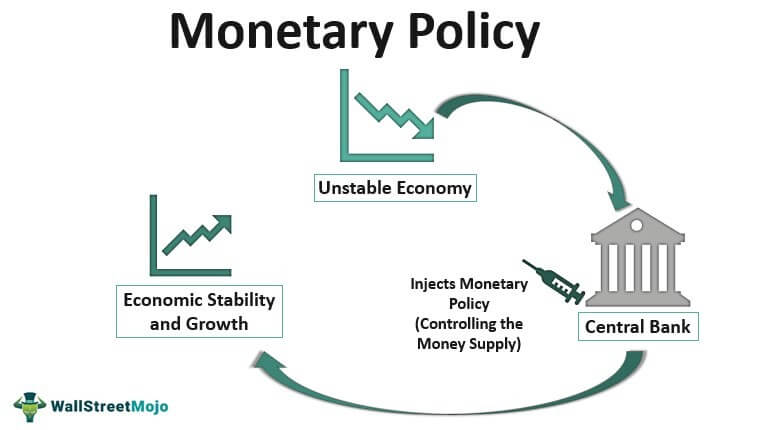

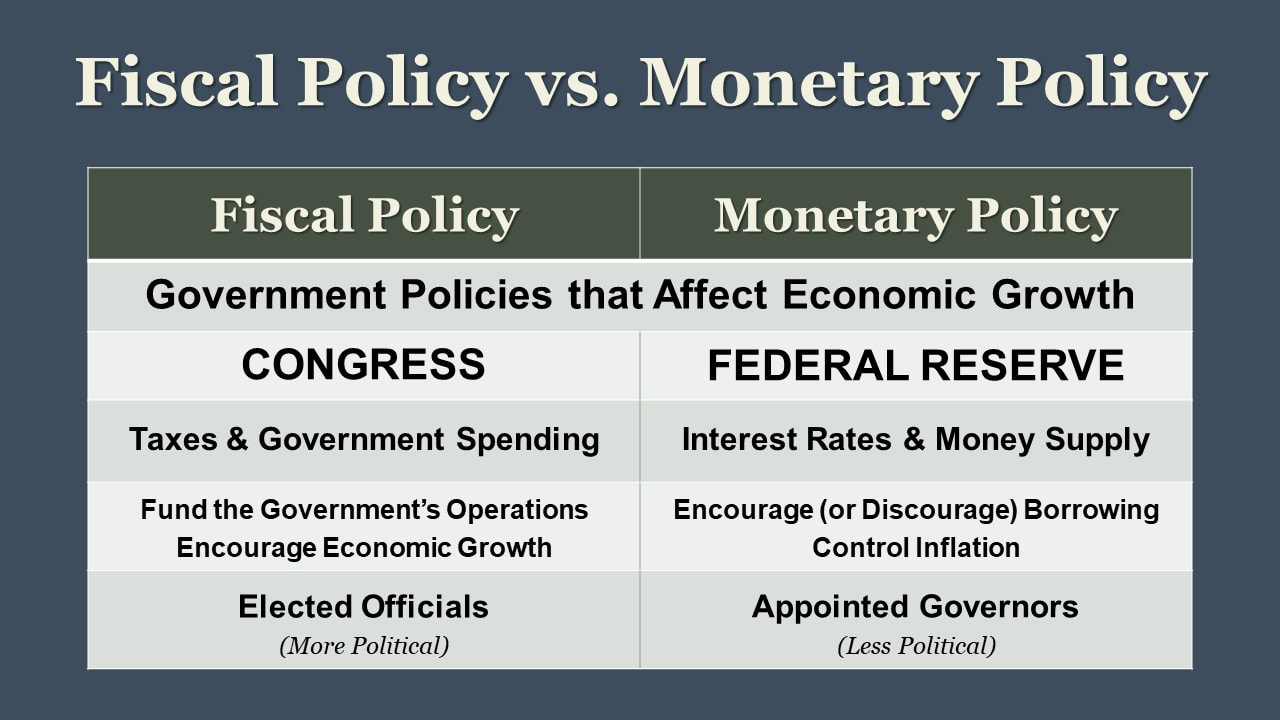

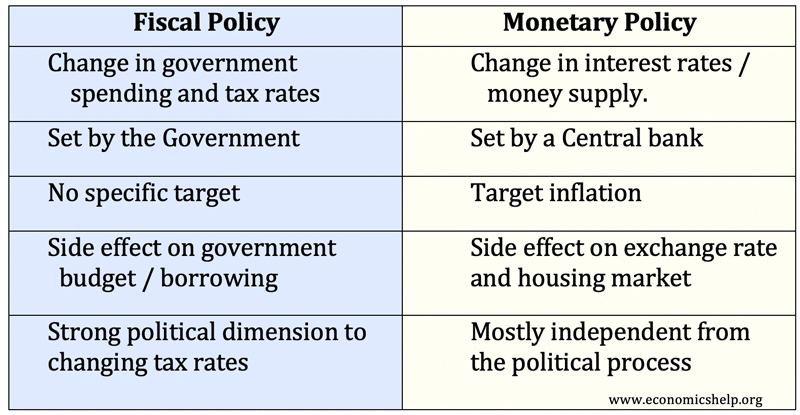

This is opposed to monetary policy which is enacted through central banks or another monetary authority. Measures taken by the central bank and treasury to strengthen the economy and minimize cyclical fluctuations through the availability and cost of credit budgetary and tax policies and other financial factors and comprising credit control and fiscal policy.

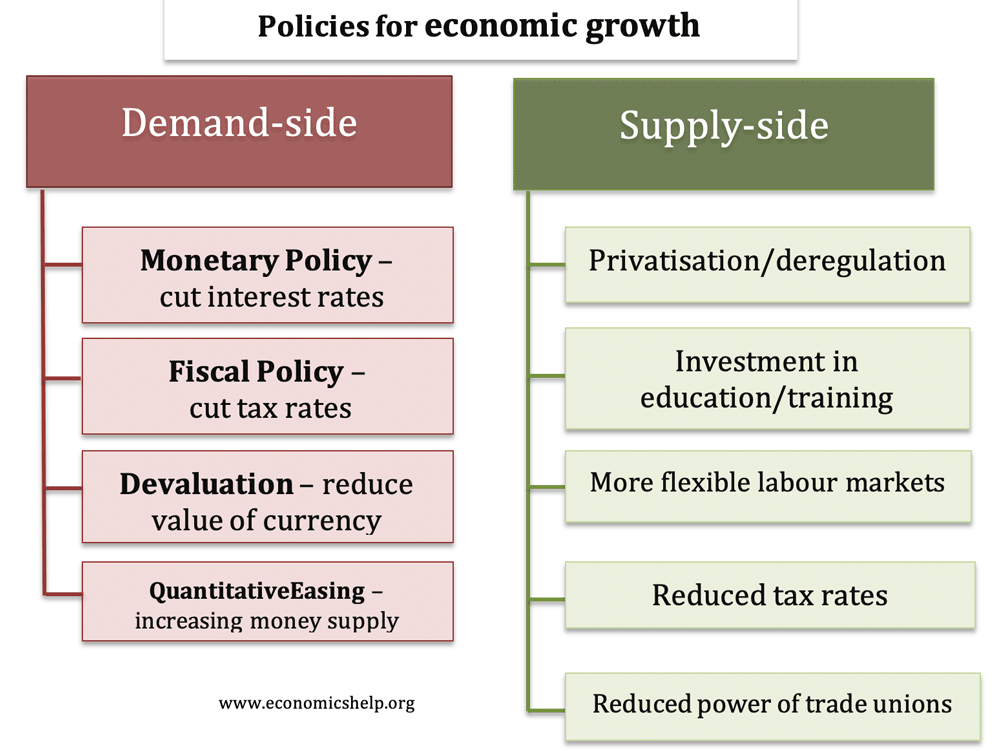

Different Types Of Economic Policies Economics Help

When overall demand slows relative to the economys capacity to produce goods and services unemployment tends.

Definition government monetary policy. It is a powerful tool to regulate macroeconomic variables such as inflation Inflation Inflation is an economic concept that refers to increases in the price level of. Monetary policy in the United States comprises the Federal Reserves actions and communications to promote maximum employment stable prices and moderate long-term interest rates--the economic goals the Congress has instructed the Federal Reserve to pursue. Monetary policy is the process by which the government central bank or monetary authority of a country controls the supply of money availability of money and cost of money or rate of interest to attain a set of objectives oriented towards the growth and stability of the economyMonetary theory provides insight into how to craft optimal monetary policy.

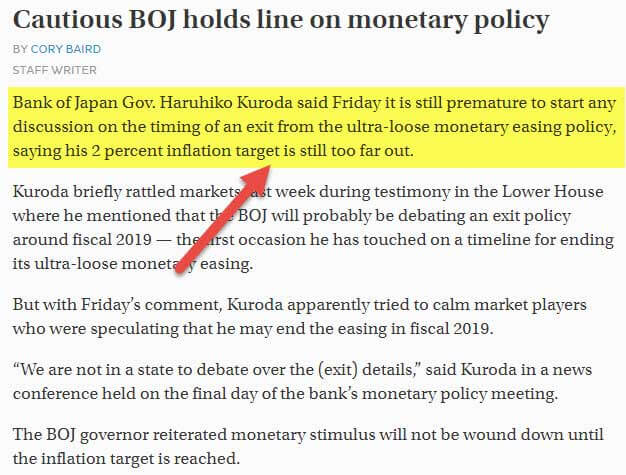

Monetary policy is a modification of the supply of money ie. The Reserve Bank is responsible for monetary policy in Australia and it sets the nations official interest rate which is referred to as the cash rate. Central banks use monetary policy to prevent inflation reduce unemployment and promote moderate long-term interest rates.

Although the governmental budget is primarily concerned with fiscal policy defining what resources it will raise and what it will spend the government also has a number of tools that it can use to affect the economy through monetary control. Monetary policy measures employed by governments to influence economicactivity specifically by manipulating the supplies of moneyand creditand by altering rates of interest. Monetary policy is primarily concerned with the management of interest rates and the total supply of money in circulation and is generally carried out by central banks such as the US.

In Australia monetary policy involves using interest rates to influence aggregate demand employment and inflation in the economy. It is by means of monetary policy that central banks control the money flowing through the economy. By lowering rates central banks hope to ease the.

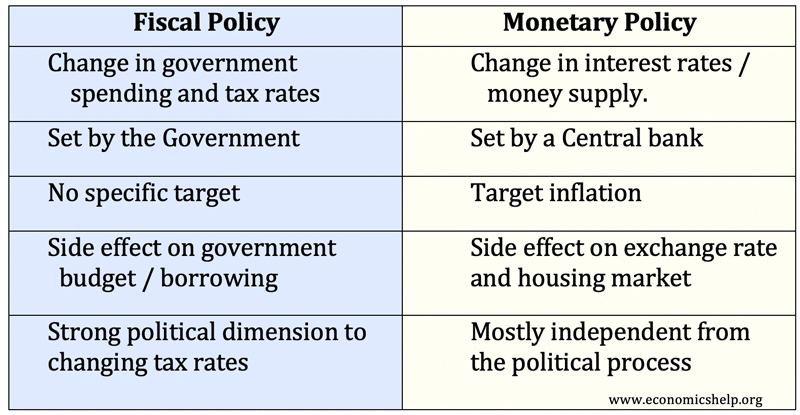

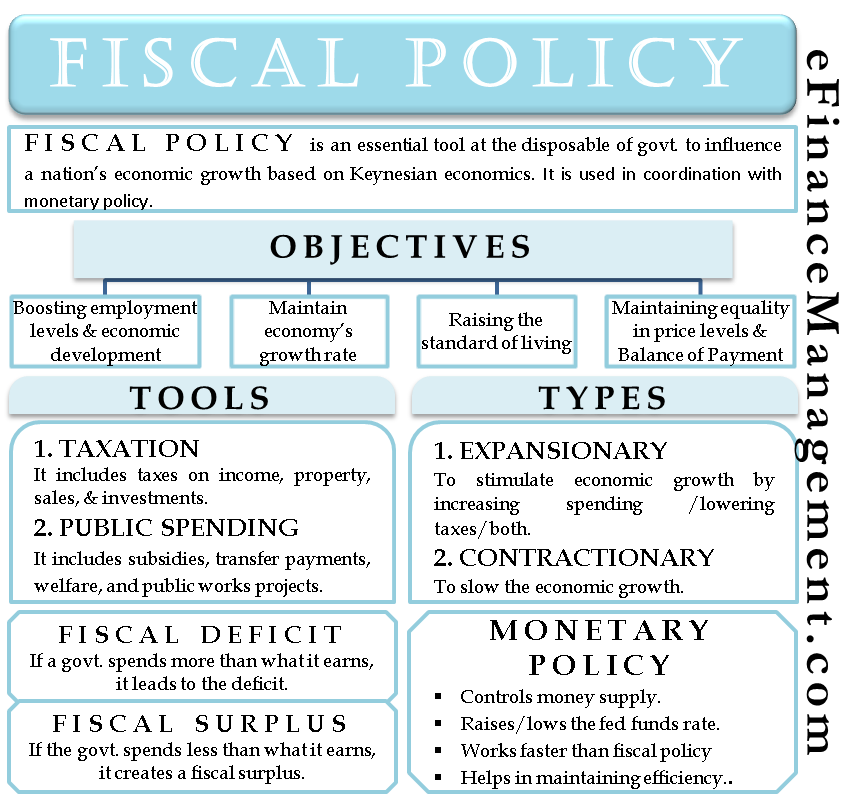

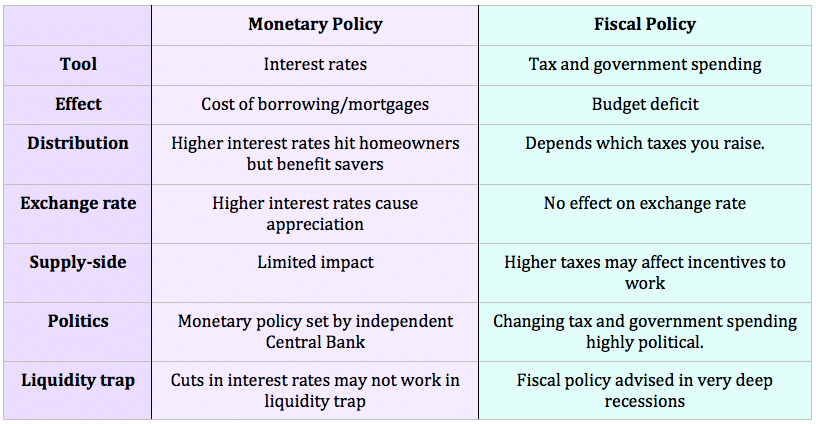

1 It is one of the main economic policies used to stabilise business cycles. It involves management of money supply and interest rate and is the demand side economic policy used by the government of a country to achieve macroeconomic objectives like inflation consumption growth and liquidity. Fiscal policy is enacted by a government.

Monetary policy is the policy or actions taken by a countrys central bank to promote economic growth and support economic goals laid out by the government such as low unemployment. Monetary policy is the macroeconomic policy laid down by the central bank. In the broadest terms monetary policy works by spurring or restraining growth of overall demand for goods and services in the economy.

Both monetary and fiscal policies are used to regulate economic activity over time. Download the complete Explainer 387 KB. Review of Monetary Policy Strategy Tools and Communications.

Printing more money or decreasing the money supply by changing interest rates or removing excess reservesThis is in contrast to fiscal policy which relies on taxation government spending and government borrowing as methods for a government to manage business cycle phenomena such as recessions. By contrast fiscal policy refers to the governments decisions about taxation and spending. By managing its portfolio of debt it can affect interest rates and by deciding on the amount of new money injected into the economy it can affect.

Definition of monetary policy. Monetary policy refers to central bank activities that are directed toward influencing the quantity of money and credit in an economy. Fiscal policy is related to the way a government is managing the aspects of spending and taxation.

Monetary policy refers to actions taken by a nations central bank such as lowering interest rates in an effort to reduce the cost of borrowing. Monetary policies are formed and managed by the central banks of a country and such a policy is concerned with the management of money supply and interest rates in an economy. Monetary policy is a central banks actions and communications that manage the money supply.

The usual goals of monetarypolicy are to achieve or maintain full employment to achieve or maintain a high rate of economic growth and to stabilize prices and wages. Monetary policy is an economic policy that manages the size and growth rate of the money supply in an economy.

Difference Between Monetary And Fiscal Policy Economics Help

Monetary Policy Definition Types Examples Tools

3 Types Of Fiscal Policy Boycewire

Monetary Policy Definition Types Examples Tools

A Look At Fiscal And Monetary Policy

3 Types Of Fiscal Policy Boycewire

What Is Fiscal Policy Its Objectives Tools And Types

3 Types Of Fiscal Policy Boycewire

What Is Fiscal Policy How It S Used The Effects

What Is Fiscal Definition And Examples Market Business News

Fiscal Policy Vs Monetary Policy Ap Government Review Tomrichey Net

Difference Between Monetary And Fiscal Policy Economics Help

Introduction To Public Economics Public Economics

Monetary Policy Vs Fiscal Policy Economics Help

Https Www Tamdistrict Org Cms Lib Ca01000875 Centricity Domain 1076 Monetary Policy Slideshow Pdf

:max_bytes(150000):strip_icc()/what-is-fiscal-policy-types-objectives-and-tools-3305844-final-5b4e4a59c9e77c005bbfde3a.png)

The Difference Between Fiscal And Monetary Policy

:max_bytes(150000):strip_icc()/what-is-monetary-policy-objectives-types-and-tools-3305867-v4-5b6888c846e0fb002546b942.png)

Monetary Policy Tools How They Work

/Economics-e22b6594e7f44dada4597c6b1ee0a2a4.jpg)

A Look At Fiscal And Monetary Policy

Post a Comment for "Definition Government Monetary Policy"