Definition Of Earnings Yield

It is the reciprocal of the PE ratio. Yield refers to the earnings generated and realized on an investment over a particular period of time.

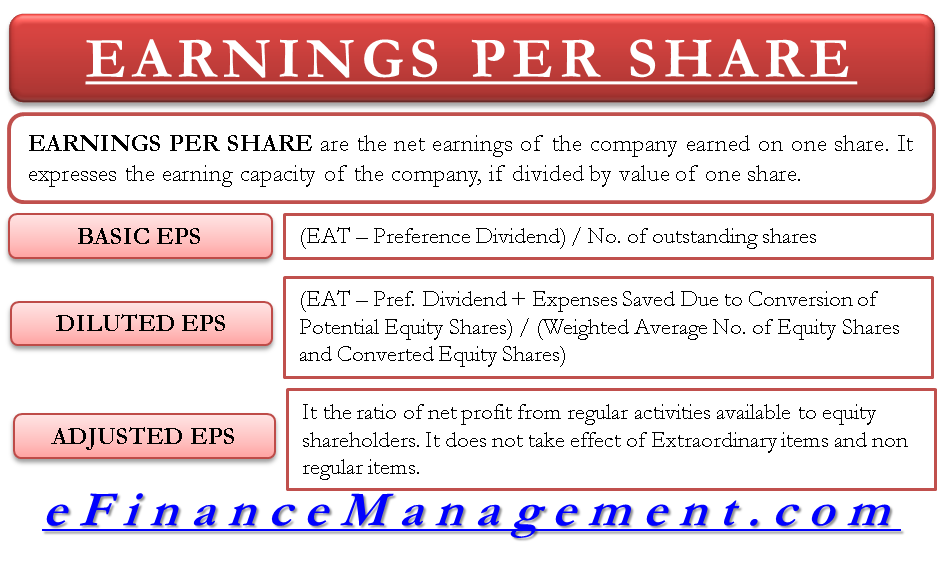

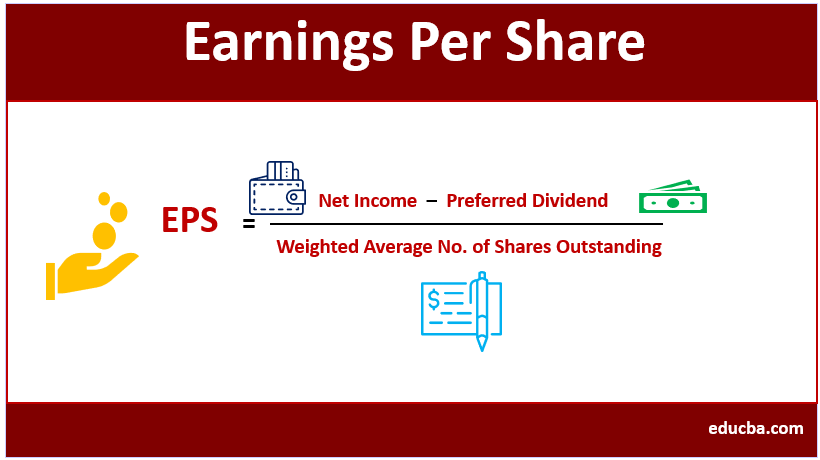

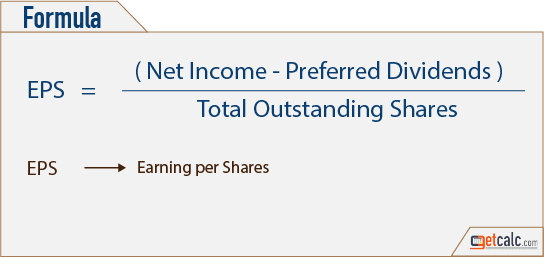

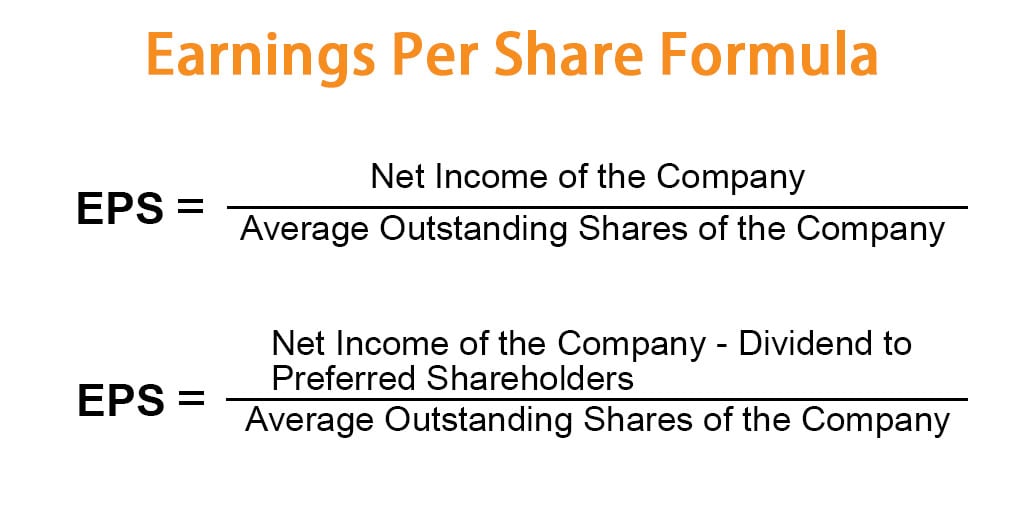

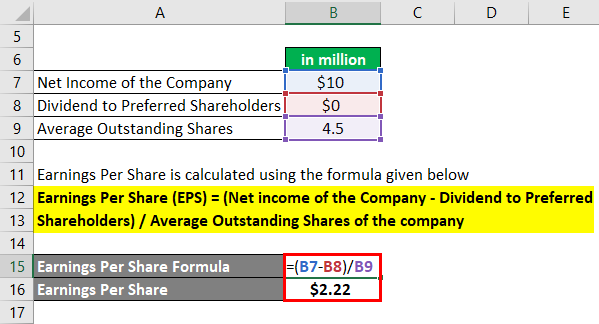

Earnings Per Share Definition Formula Example Interpretation Analysis

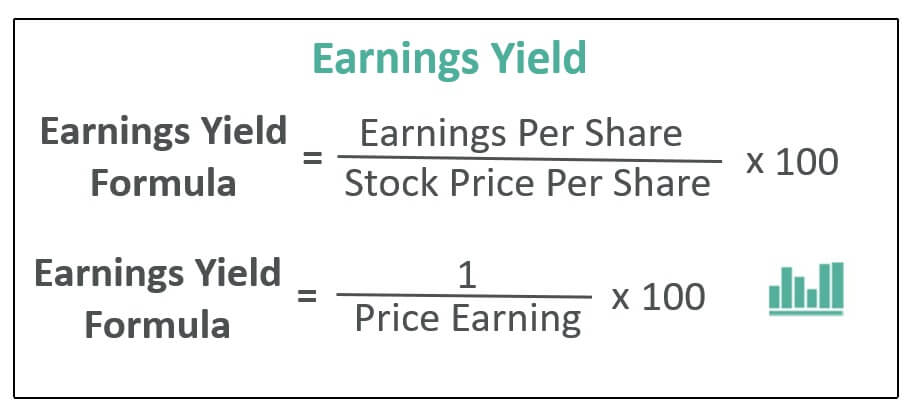

The quick formula for Earnings Yield is EP earnings divided by price.

Definition of earnings yield. Earnings yield explained simply. Earnings yield is a measure of a companys earnings relative to its market cap. For example Ive pulled up Big Cheeses 2016 financial.

Earnings Yield helps the investor understand how much he will be earning for each dollar invested in the company and is therefore calculated as Earnings per share are divided by the stock price per share. A low ratio may indicate an overvalued. The inverse of the price-earnings ratio.

Earnings yield is one indication of value. Earnings yield The ratio of earnings per share after allowing for tax and interest payments on fixed interest debt to the current share price. What Is a Yield.

Stockopedia explains Earnings Yield. The inverse of the price-earnings ratio. Thus Earnings Yield EPS Price 1 PE Ratio expressed as a.

It is the total twelve months earnings divided by number of outstanding shares divided by. The earning yield is quoted as a percentage and therefore allows immediate comparison to prevailing long-term interest rates eg. The earnings yield is a calculation of the companys past 12-months earnings per share divided by the current market price of one share.

The ratio of earnings per share after allowing for tax and interest payments on fixed interest debt to the current share price. Want to learn more. The earnings yield is quoted as a percentage.

Earnings yield is the 12-month earnings divided by the share price. The earnings yield is a way to measure returns and it helps investors evaluate whether those returns commensurate with an investment s risk. Improve your vocabulary with English Vocabulary in Use from Cambridge.

Check out the earnings yield definition and what are the uses of earnings yield015 PE ratio and earnings yield049 Earni. The yield is a good ROI metric and can be used to measure a stocks rate of return. It is the reciprocal of the PE ratio.

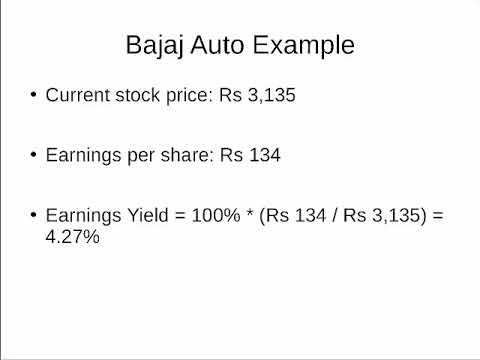

A ratio of nine percent means that annual operating earnings equivalent to nine percent of the companys market cap are being generated yearly. The earnings yield is quoted as a percentage which illustrates the percentage of each dollar invested that was earned by the company during the past twelve months. Earnings yield is defined as EPS divided by the stock price EP.

This ratio helps an investor to make the comparison between two or more companies or between investment in shares versus the investment in risk-free security. In other words it is the reciprocal of the PE ratio. It is the total twelve months earnings divided by number of outstanding shares divided by the recent price multiplied by 100.

The earnings yield is the inverse ratio to the price-to-earnings PE ratio. Earnings yield is the quotient of earnings per share divided by the share price. The Earnings Yield is a measure of how much a company earns relative to its Enterprise Value.

Earnings yield is earnings per share from the previous four quarters divided by the share price. Its expressed as a percentage based on the invested amount current market value or face value of the security. Operating Earnings Yield The operating earnings yield is annualized operating income as a percentage of the total value of the companys common stock.

Generally the higher this ratio is the better. This is measured on a TTM basis. The earnings yield has moved more or less in step with long-term bond rates.

It is defined as the Earnings Before Interest and Tax divided by the Enterprise Value. A way of measuring financial performance by comparing a companys earnings per share in a particular period with its share price. For example the investor may not feel that 75 adequately compensates for the added risk of owning XYZ Company stock if lower-risk stocks carry yields of 85.

Yield includes the interest earned or dividends received from holding a particular security. Earning yield is the quotient of earnings per share E divided by the share price P giving EP. It is the ratio of earnings per share after allowing for tax and interest payments on fixed interest debt to the current share price.

Earnings yield is the earnings per share of a security divided by its market price. Owners of a stock can consider a companys earnings yield as a measure. It is the reciprocal of the PE ratio.

Earnings yield is the inverse of the PE ratio.

Earnings Per Share Advantages And Limitations Of Earnings Per Share

What Is A P E Ratio Price To Earnings Ratio Definition

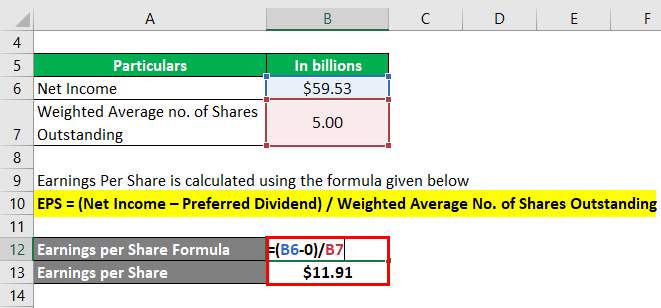

Cash Earnings Per Share Cash Eps Ratio Formula Example Calculation

Earnings Yield Definition Formula Calculation Examples

Earnings Per Share Advantages And Limitations Of Earnings Per Share

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Eps Earnings Per Share Calculator

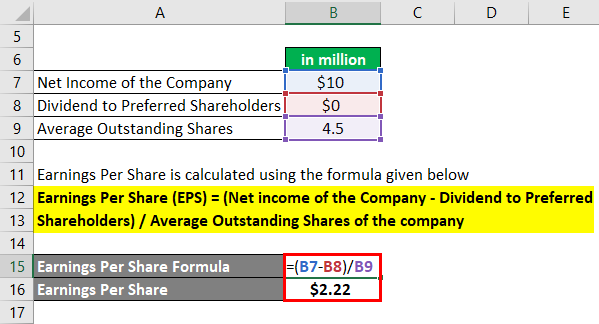

Earnings Per Share Formula Eps Calculator With Examples

The Chapter Covers Meaning Of Cost Of Capital Ppt Video Online Download

Difference Between Dividend Yield And Earnings Yield With Table

Earnings Per Share Eps Fundamental Analysis Common Stock Smart Money

P E Ratio Vs Earnings Yield Explanation Formulas

Earnings Per Share Formula Eps Calculator With Examples

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Earnings Yield Formula Calculation Equitymaster Com Youtube

Earnings Yield Definition Formula Calculation Examples

Earnings Yield Definition Formula Calculation Examples

Post a Comment for "Definition Of Earnings Yield"