Definition Of Qualified Family Leave Wages

Qualifying wages are those paid to an employee who takes leave under the act for a qualifying reason up to the appropriate per diem and aggregate payment caps. Because qualified sick leave and family leave wages arent subject to the employer portion of Social Security tax you only need to multiply those wages by 62 0062.

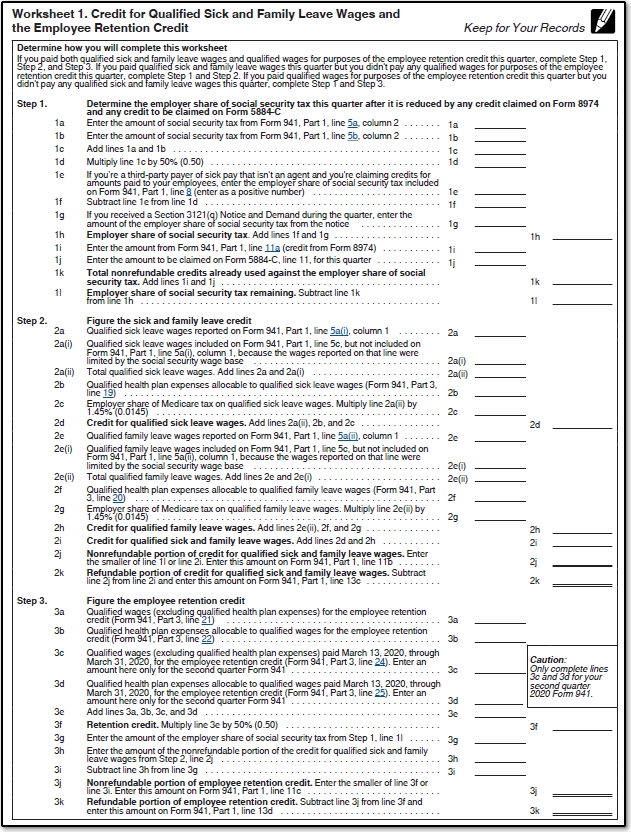

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

It allows most employees to receive up to 12 weeks of paid leave for.

Definition of qualified family leave wages. Visit Eligibility Requirements to learn more. The qualified sick leave wages and qualified family leave wages are not subject to the taxes imposed on employers by sections 3111a and 3221a of the code and employers other than those that are subject to the Railroad Retirement Tax Act are entitled to an additional credit for the taxes on employers imposed by section 3111b of the code Hospital Insurance Medicare tax on such. The Family and Medical Leave Act FMLA entitles eligible employees of covered employers to take unpaid job-protected leave for specified family and medical reasons.

IR-2020-144 July 8 2020. The Employment Security Department administers the Paid Family and Medical Leave program. Qualified family leave wages are wages as defined in section 3121a of the Internal Revenue Code the Code determined without regard to section 3121b1-22 of the Code and section 7005a of the FFCRA and compensation as defined in section 3231e of the Code determined without regard to the exclusions under section 3231e1 of the Code and without regard to section 7005a of the FFCRA that Eligible Employers pay eligible employees for periods of leave during which they.

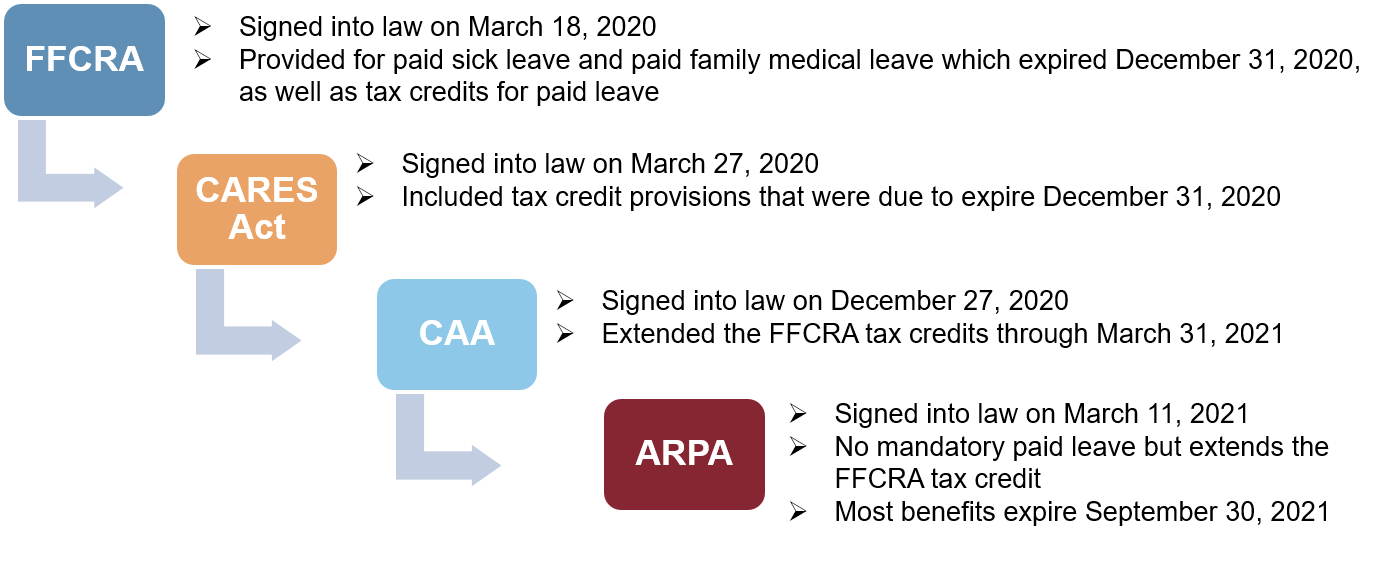

However the Emergency Paid Sick Leave Act requires that paid sick leave be paid only up to 80 hours over a two-week period. Qualified sick leave wages and qualified family leave wages are wages as defined in section 3121 a that an employer is required to pay under the Emergency Paid Sick Leave Act or the Emergency Family and Medical Leave Expansion Act or voluntarily pays under the COVID-related Tax Relief ACT of 2020. Qualified sick leave and family leave wages are required for applicable situations under the FFCRA.

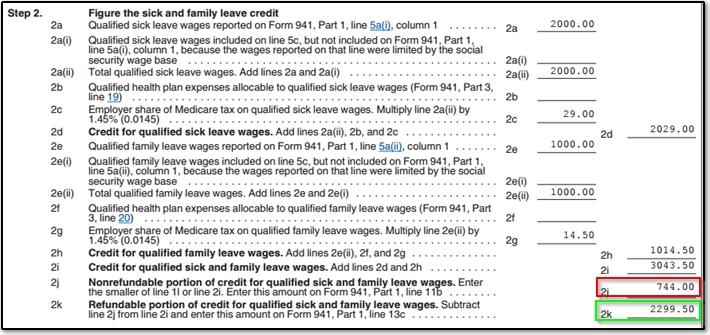

Bonding after the birth or placement of a child. The total sick or family leave wages are then added to the qualified health plan expenses allocable to these wages line 19 or 20 of Form 941 Part 3 and the employer portion of Medicare tax allocable to these wages. A payment of qualified leave wages can enable an employees 2020 compensation to reach the Social Security wage base with respect to employee and employer obligations even though such wages are exempt from the employer portion of Social Security tax an IRS representative said.

The program is a state-run insurance benefit passed by the Legislature in 2017. These FAQs address the tax credits available under the American Rescue Plan Act of 2021 the ARP by employers with fewer than 500 employees and certain governmental employers without regard to the number of employees Eligible Employers for qualified sick and family leave wages qualified leave wages paid with respect to leave taken by employees beginning on April 1. Have a loss of wages because you need to take time off work to care for a seriously ill family member bond with a new child or participate in a family members qualifying military event.

Under the Paid Family and Medical Leave PFML law most Massachusetts employers are responsible for remitting family and medical leave contributions to the Department of Family and Medical Leave on behalf of their covered individuals. This can include W-2 employees and in some cases 1099-MISC contractors. Section 288 of the COVID-related Tax Relief Act of 2020 clarified.

The Emergency Family and Medical Leave Expansion Act requires you to pay an employee for hours the employee would have been normally scheduled to work even if that is more than 40 hours in a week. Twenty-six workweeks of leave during a single 12-month period to care for a covered servicemember with a serious injury or illness if the eligible employee is the servicemembers spouse son daughter parent or next of kin military caregiver leave. On July 16 2020 Wage and Hour Division announced a Request for Information RFI to be published in the Federal Register.

The definition of qualified wages depends on how many employees an eligible employer has. Employers will be required to report these. For 2021 the Social Security wage base is 142800.

The sick and family leave amounts are then added together for the total credit. WASHINGTON The Treasury Department and the Internal Revenue Service today provided guidance in Notice 2020-54 to employers requiring them to report the amount of qualified sick and family leave wages paid to employees under the Families First Coronavirus Response Act FFCRA on Form W-2. If an employer averaged more than 100 full-time employees during 2019 qualified wages are generally those wages including certain health care costs up to 10000 per employee paid to employees that are not providing services because operations were suspended or due to the decline in gross receipts.

Qualified sick leave wages are wages as defined in section 3121 a of the Internal Revenue Code the Code determined without regard to section 3121 b 1- 22 of the Code and section 7005 a of the FFCRA and compensation as defined in section 3231 e of the Code determined without regard to the exclusions under section 3231 e 1 of the Code and without regard to section 7005 a of the FFCRA that Eligible Employers pay eligible employees for periods of leave during.

Your Job Should Be Your Job It Should Not Consume All Of Your Life Work Quotes Job Quotes Positive Quotes

U S Department Of Labor Wage And Hour Division Whd Fair Labor Standards Act Flsa Minimum Wage Poster Minimum Wage Wage Obama

Federal Coronavirus Paid Fmla Sick Leave Tax Credits Cbia

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

The Truth About Constructive Feedback Career Advice Minimum Wage Job

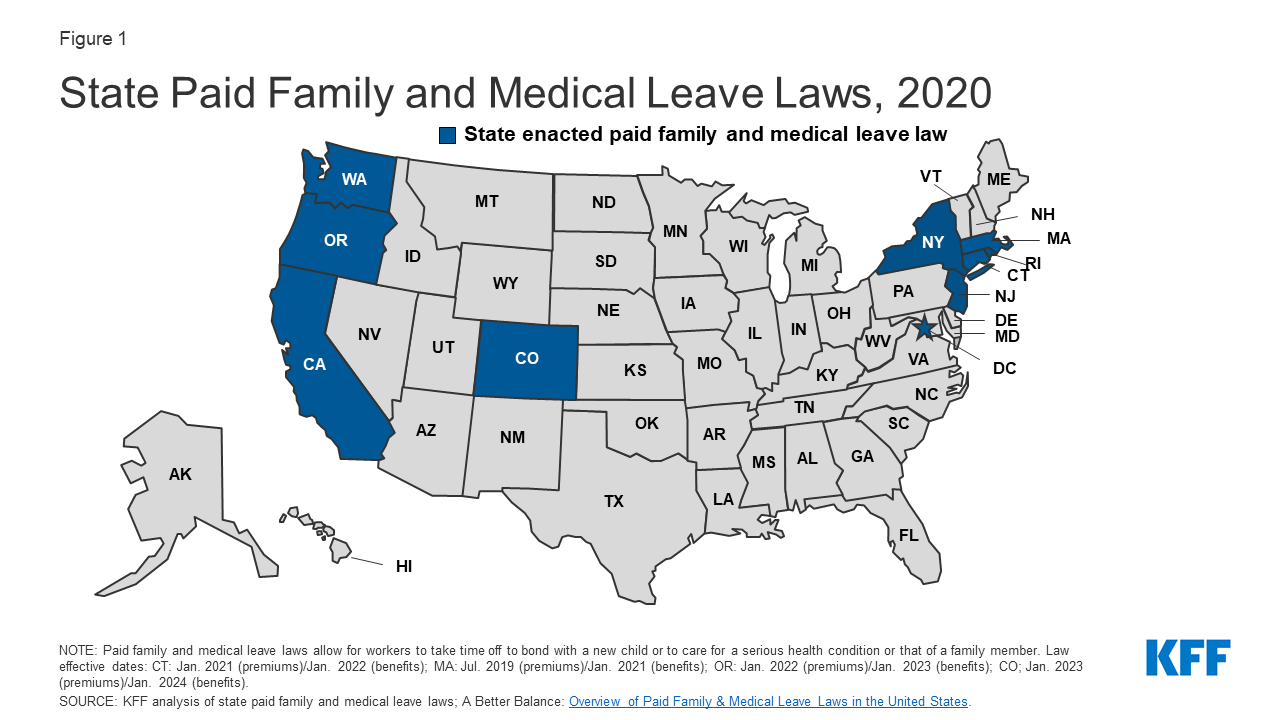

Paid Family And Sick Leave In The U S Kff

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Are You Eligible For Medical Leave Under The Family Medical Leave Act Fmla Mansell Law Employment Attorneys

Learn Quiz On Properties Of Crystalline Solids Chemistry Quiz 169 To Practice Free Chemistry Mcqs Ques College Chemistry Chemistry Quiz Questions And Answers

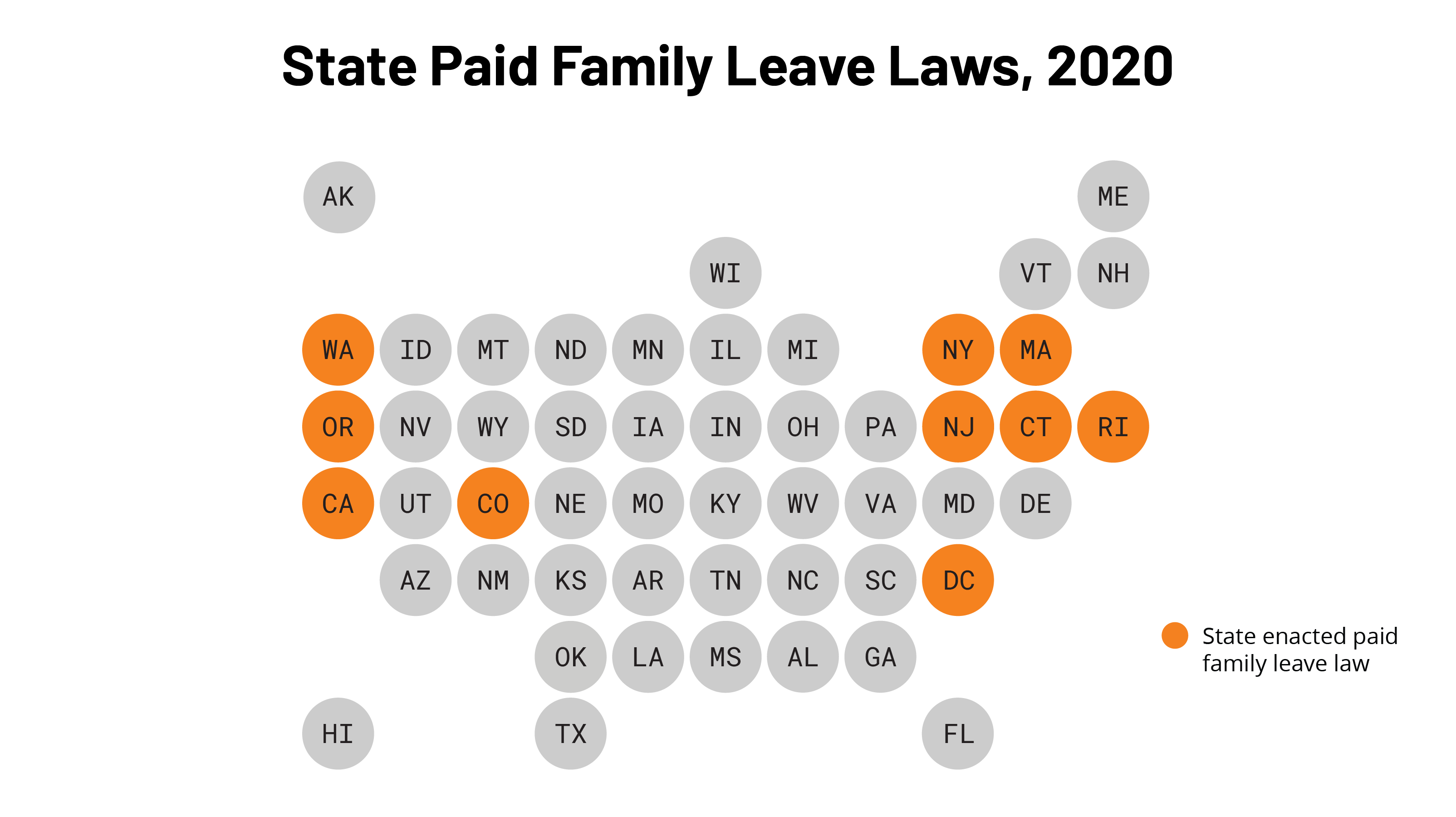

Time Off To Care State Actions On Paid Family Leave

Paid Family And Sick Leave In The U S Kff

Key Takeaways For Employers The Arpa S Expanded Sick Family Medical Leave And Cobra Benefits Eckert Seamans

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Texas Aft Absences Personal Leave For School Employees Texas Aft

An Overview Of The Families First Coronavirus Response Act For Public Employers

Time Off To Care State Actions On Paid Family Leave

Miplanforlife Miplan Https Www Facebook Com Miplanforlife Life Insurance Facts Life Insurance Insurance Marketing

The Finance Effect Money Management Financial Freedom Quotes Financial Quotes Pay Yourself First

Post a Comment for "Definition Of Qualified Family Leave Wages"