Individual Mandate Definition Health Insurance

5000A which describes a fee for people who fail to get health insurance by the deadline each year. Penalty fees increase each year based on inflation.

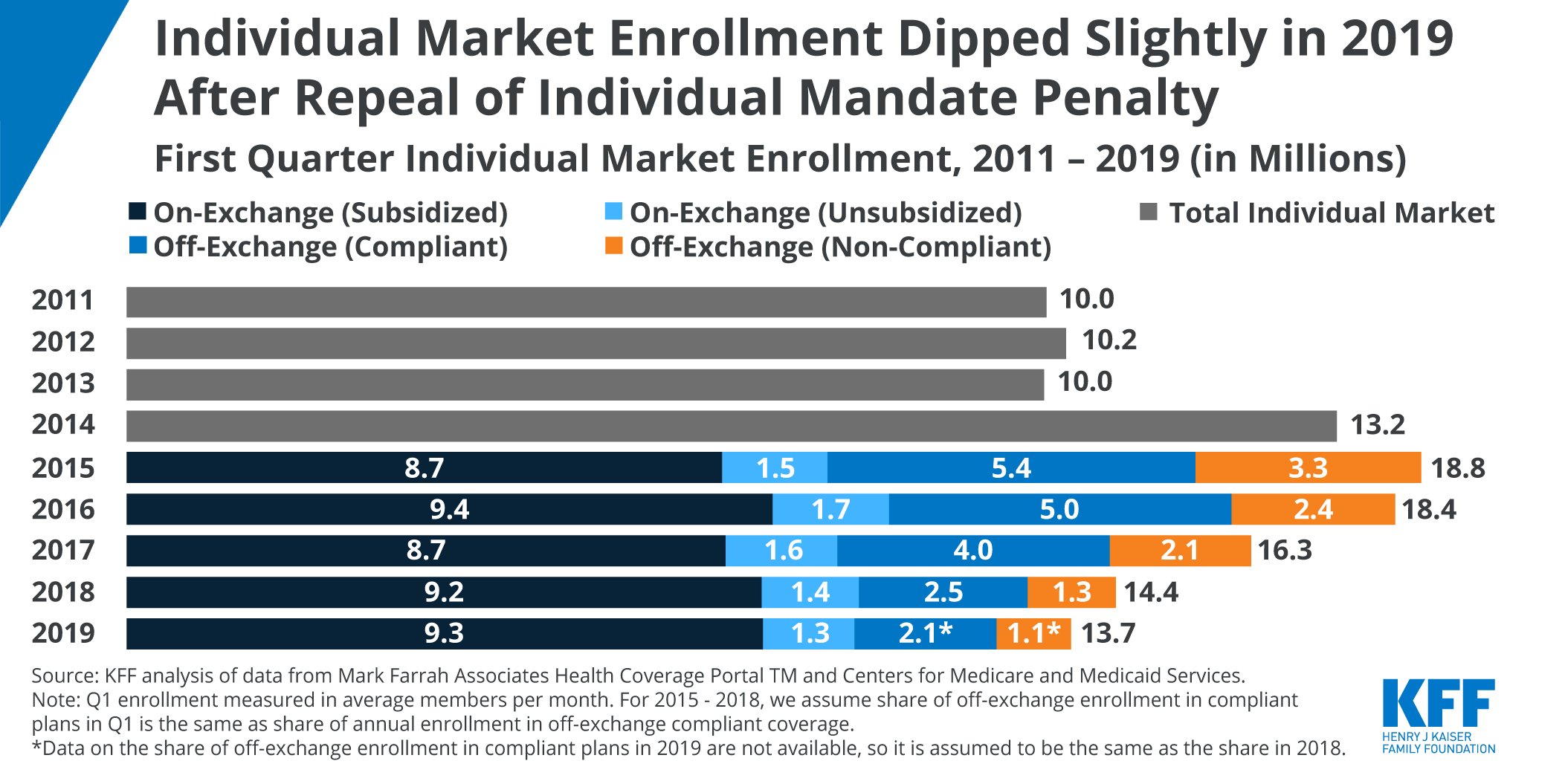

Data Note Changes In Enrollment In The Individual Health Insurance Market Through Early 2019 Kff

See if youll owe a fee For plan years through 2018 if you can afford health insurance but choose not to buy it you may pay a fee called the individual Shared Responsibility Payment when you file your federal taxes.

Individual mandate definition health insurance. The fee is sometimes called the penalty fine or individual mandate. 5 Massachusetts had significant regulations in its individual market both before and after the reform including requirements that insurers must offer coverage to all applicants and that older adults. This new mandate also creates an enforcement nightmare.

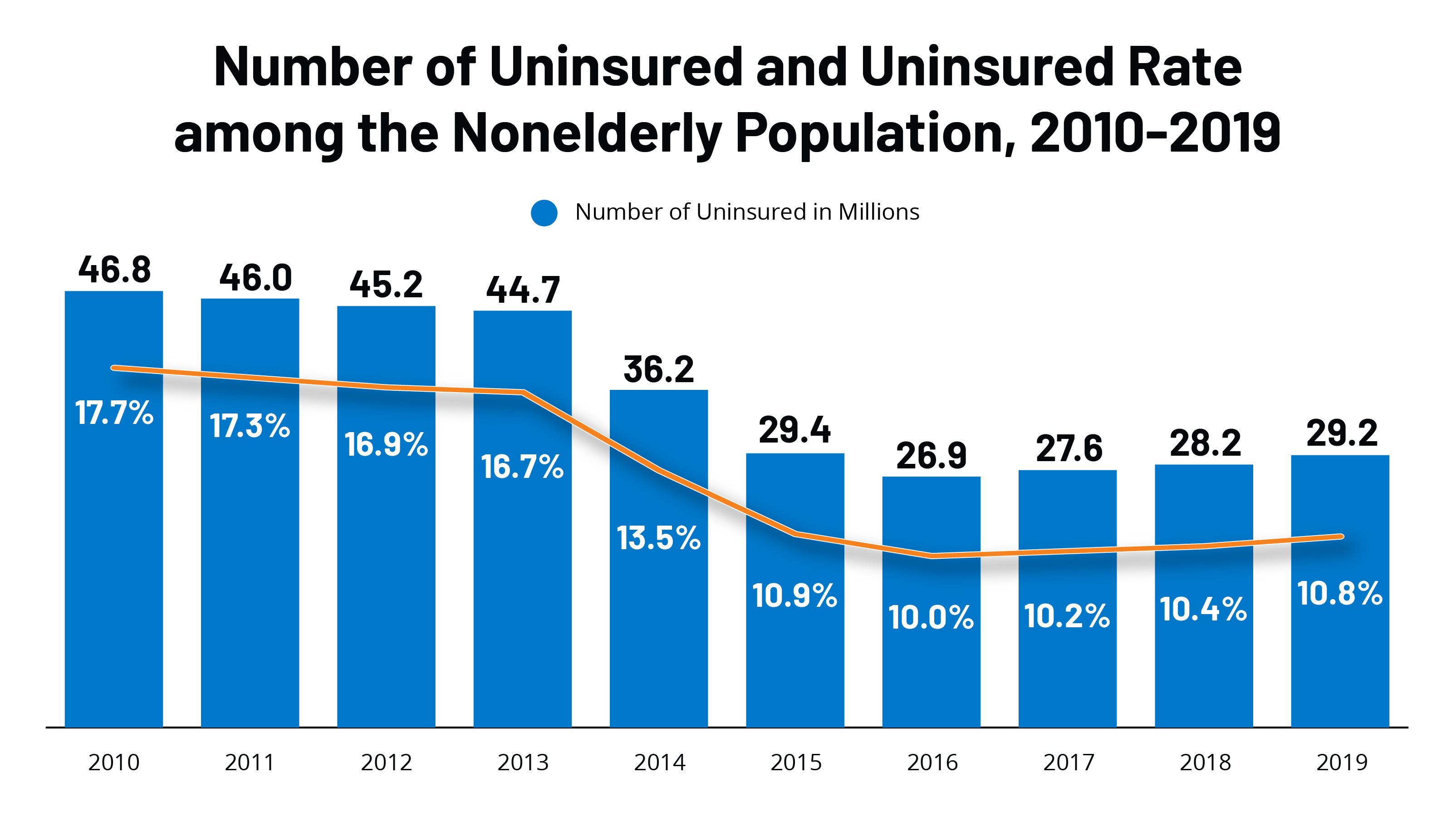

Have qualifying health coverage. The sweeping tax reform package recently signed into law will eliminate the Affordable Care Acts ACAs individual mandate in 2019 which is projected to reduce the number of people covered by health insurance by 4 million in 2019 and 13 million in 2027 while increasing premiums in the nongroup market by about 10 annually1 For taxpayers seeking protection from. An individual mandate is a requirement by law for certain persons to purchase or otherwise obtain a good or service.

The rule that requires you to get covered is called the individual mandate. The concept of the individual health insurance mandate is considered to have originated in 1989 at the conservative Heritage Foundation. This requirement is commonly referred to as the laws individual mandate.

As a presidential candidate Barack Obama opposed the individual mandate for health insurance in part because he considered it. People who do not have health insurance must obtain it or pay a penalty. The individual mandate remains one of the ACAs most politically charged provisions.

The individual mandate is a requirement that all individuals who can afford health-care insurance purchase some minimally comprehensive policy. 1 However your state of residence may require you and each member of your family to do at least one of the following or face a tax penalty. The individual mandate also called the individual shared responsibility payment is no longer applicable in most states as of 2019.

In 1993 Republicans twice introduced health care bills that contained an individual health insurance mandate. Citizens and legal residents to either have health insurance or pay a tax for not doing so beginning in 2014. A number of healthcare benefits are mandated by either state law.

The individual mandate is a provision within the Affordable Care Act that required individuals to purchase minimum essential coverage or face a tax penalty. Mandated benefits also known as mandated health insurance benefits and mandates are benefits that are required to cover the treatment of specific health conditions certain types of healthcare providers and some categories of dependents such as children placed for adoption. For the provision of the Affordable Care Act see Individual shared responsibility provision.

1 Those who didnt comply were subject to an extra tax. Starting in 2014 the Affordable Care Act Obamacare required all Americans to maintain minimum essential health coverage unless they qualified for an exemption. The individual mandate required people with incomes above 150 percent of poverty to enroll in insurance or pay a penalty based on half the cost of the cheapest plan available in the individual market.

What Is the Individual Mandate. On June 02 2020. What it is.

The health care reform legislation that became law in 2010 - known officially as the Affordable Care Act and also as Obamacare - requires most Americans to have a basic level of health insurance coverage. Individual Mandate of the Healthcare Law NFIB Facts About PPACA Individual Mandate The keystone of the Patient Protection and Affordable Care Act PPACA is an unprecedented individual mandate tax requiring virtually all US. Within those pages penalties for not complying with the law are referenced in section 1501 Chapter 84 26 USC.

The individual mandate which took effect on January 1 2014 is a requirement of the ACA that most citizens and legal residents of the United States have health insurance.

Pin On New Visions Healthcare Blog

What You Need To Know About Short Term Health Insurance Insure Com

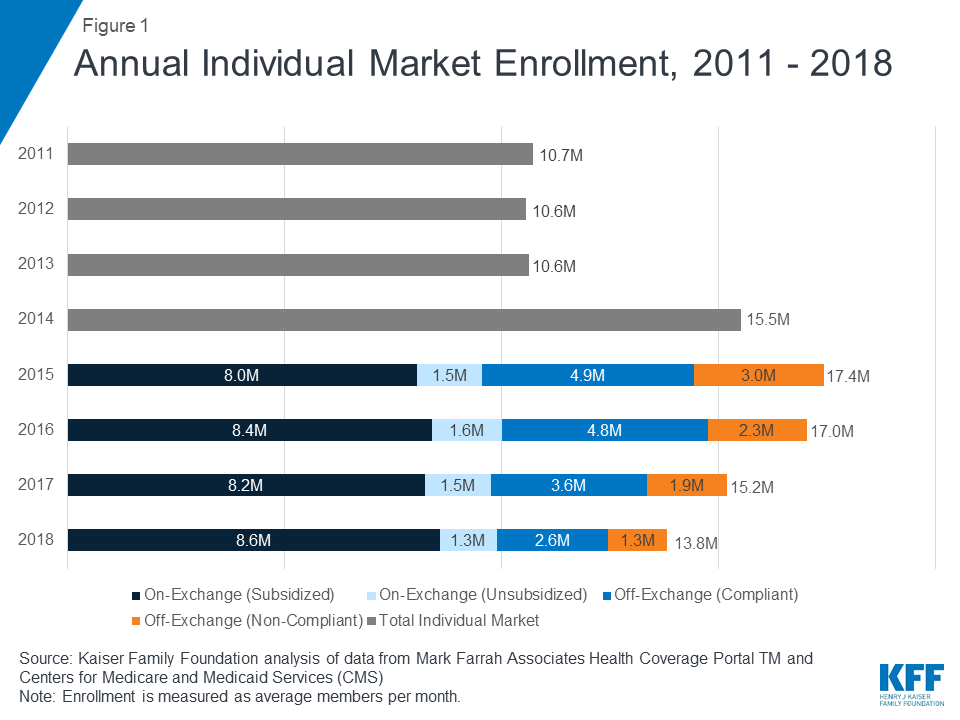

Data Note Changes In Enrollment In The Individual Health Insurance Market Through Early 2019 Kff

Individual Health Insurance Under Obamacare Healthinsurance Org

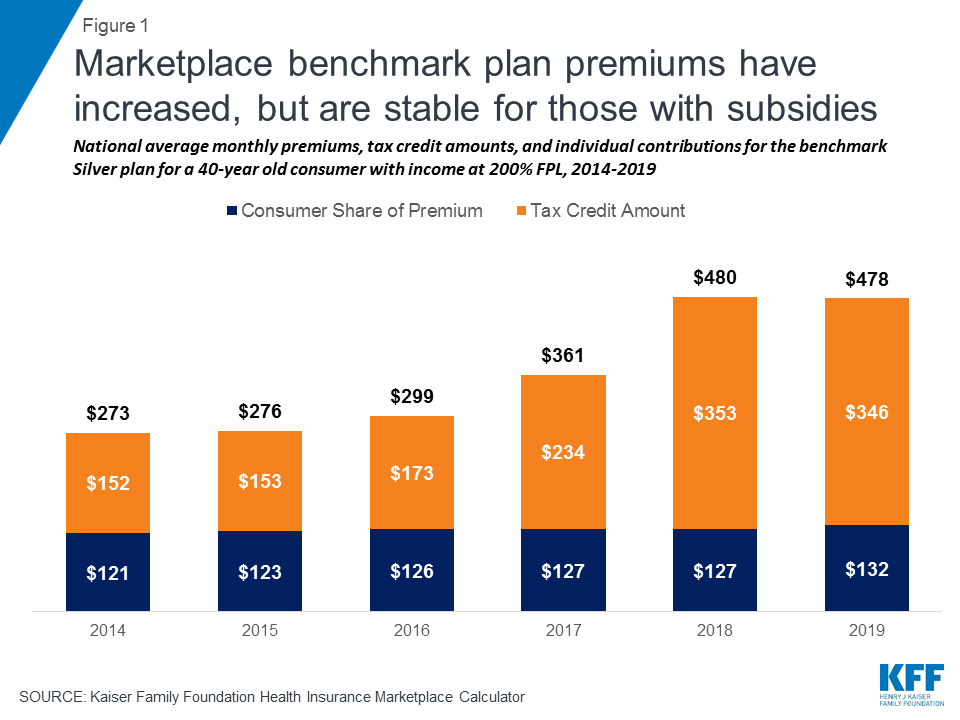

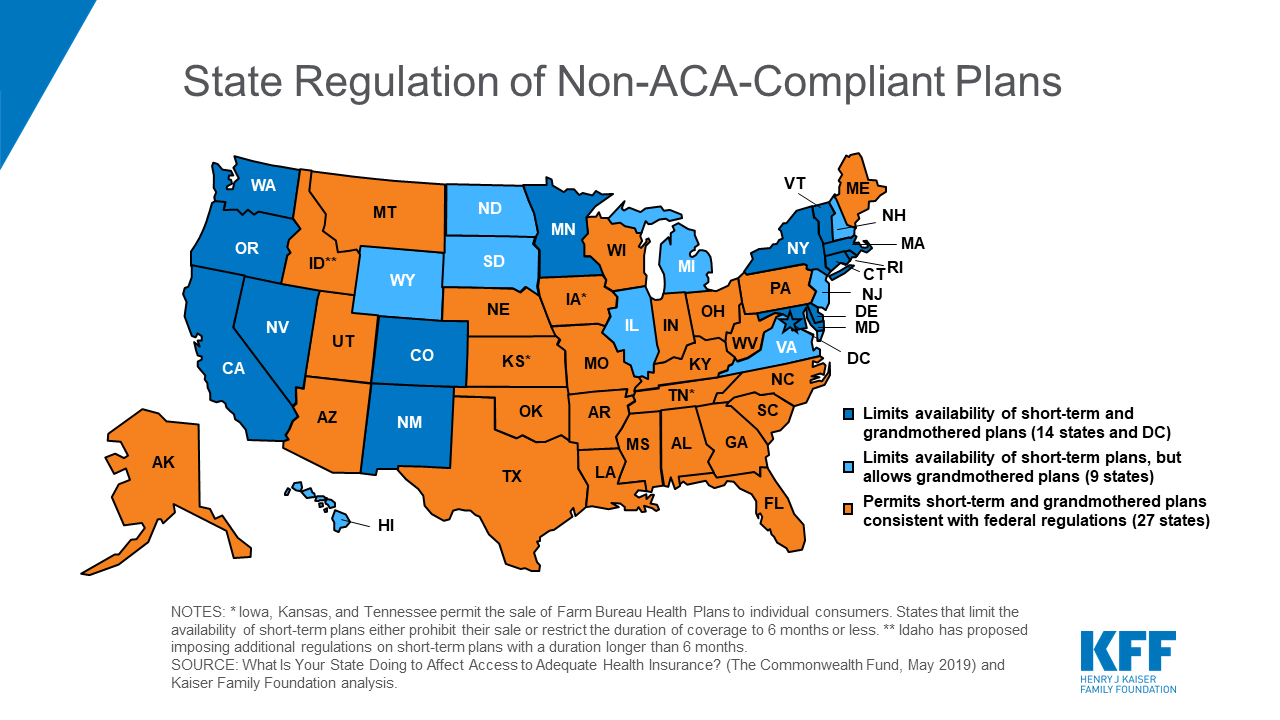

State Actions To Improve The Affordability Of Health Insurance In The Individual Market Kff

Find Affordable Health Insurance And Compare Quotes

Ispetinsuranceworthit Health Insurance Best Health Insurance Infographic Health

Individual Health Insurance Under Obamacare Healthinsurance Org

Individual Health Insurance Plans Quotes California Hfc

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Obamacare Minimum Essential Coverage 10 Essential Benefits

Will You Owe A Penalty Under Obamacare Healthinsurance Org

Potential Impact Of California V Texas Decision On Key Provisions Of The Affordable Care Act Kff

Obamacare Minimum Essential Coverage 10 Essential Benefits

What We Do And Don T Know About Recent Trends In Health Insurance Coverage In The Us Kff

Self Employed Health Insurance Deduction Healthinsurance Org

The Future Of U S Health Care Replace Or Revise The Affordable Care Act Rand

State Actions To Improve The Affordability Of Health Insurance In The Individual Market Kff

Post a Comment for "Individual Mandate Definition Health Insurance"