Definition Of Government Bonds

Treasury bonds T-bonds are one of four types of debt issued by the US. How do government bonds work.

What Are Treasury Bills Definition And Meaning Market Business News

General bonds such as construction bonds and debt financing bonds.

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

Definition of government bonds. GOVERNMENT natural and political law. Such bonds are most often denominated in the countrys domestic currency. Money raised from the sale of treasuries.

Almost 70 of all debt in a sample of developing countries from 1979 through 2006 was denominated in US dollars. A government bond is a type of debt-based investment where you loan money to a government in return for an agreed rate of interest. How Debt Securities Work A debt security is a type of financial asset that is created when one party lends money to another.

Governments use them to raise funds that can be spent on new projects or infrastructure and investors can use them to get a set return paid at regular intervals. Most are negotiable with prominent examples being Treasury securities or Ginnie Mae bonds. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time.

Sovereigns can also issue debt in foreign currencies. Bonds such as government bonds corporate bonds municipal bonds collateralized bonds and zero-coupon bonds are a common type of debt security. A government bond is a debt security issued by a government to support government spending and obligations.

Any bond issued by an agency of the United States government. Sometimes by the word government is. Cannot be bought and sold once the original purchase is made.

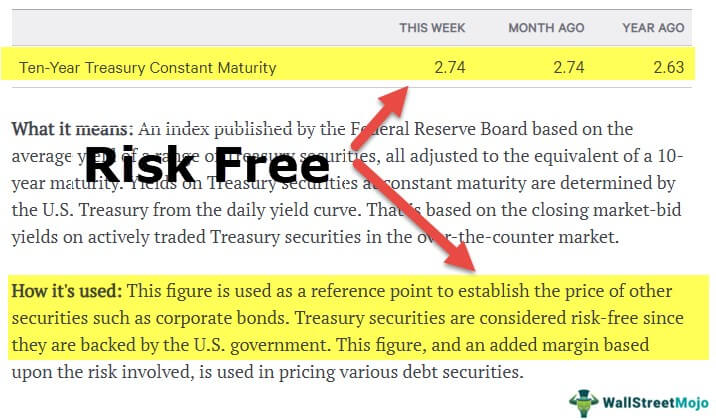

Government bonds are backed by the full faith and credit of the government and are considered risk-free. Government bond - a bond that is an IOU of the United States Treasury. Government bonds are backed by the full faith and credit of the government and are considered risk-free.

Savings bonds however are not negotiable. A government bond is debt issued by the government. Department of the Treasury to finance the US.

A government bond is a bond issued by a national government. The four types of debt are Treasury bills. Federal government bonds The reduced yield is attributed to the federal governments ability to print money and collect tax revenue which significantly lowers their chance of default.

There are three simple forms of government the democratic the aristocratic and monarchical. Governments debt is considered risk-free for this reason. When you buy a bond you are lending to the issuer which may be a government municipality or corporation.

Government bonds are issued by the federal government. They are commonly known as treasuries because they are issued by the US. For example a bondholder invests 20000 called face value into a 10-year government bond with a 10 annual coupon.

Governments use them to raise funds that can be spent on new projects or infrastructure and investors can use them to get a set return paid at regular intervals. But these three simple forms may be varied to infinity by the mixture and divisions of their different powers. The government uses these funds for welfare schemes capital project financing operating expenses and other financial obligations.

Considered the safest security in the investment world savings bond - non-negotiable government bond. Savings bonds however are not negotiable. A bond is a debt security similar to an IOU.

It generally includes a commitment to pay periodic interest called coupon payments and to repay the face value on the maturity date. Treasury Department usually issues United States government bonds. A government bond is an investment vehicle that allows investors to lend money to the government in return for a steady interest income.

A government bond or sovereign bond is an instrument of indebtedness a bond issued by a national government to support government spending. Most are negotiable with prominent examples being Treasury securities or Ginnie Mae bonds. Government bonds can pay periodic.

A government bond is a type of debt-based investment where you loan money to a government in return for an agreed rate of interest. Any bond issued by an agency of the United States government. Bonds of the Fiscal Loan and Investment Program FILP which can be used to raise funds for the investment of the Fiscal Loan Fund.

The manner in which sovereignty is exercised in each state.

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

Treasury Bills T Bills Definition

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

How Are Bond Yields Affected By Monetary Policy

The Functionalities Of Corporate And Government Bonds Relawding

What Are Bonds Definition Features And Types Business Jargons

What Is A Bond Introduction To Bonds Definition Of Corporate Bonds Govt Bonds With Examples Youtube

Treasury Bond T Bond Definition Example How It Works

Government Bonds Meaning Types Advantages Disadvantages Scripbox

Treasury Bills Vs Bonds Top 5 Best Differences With Infographics

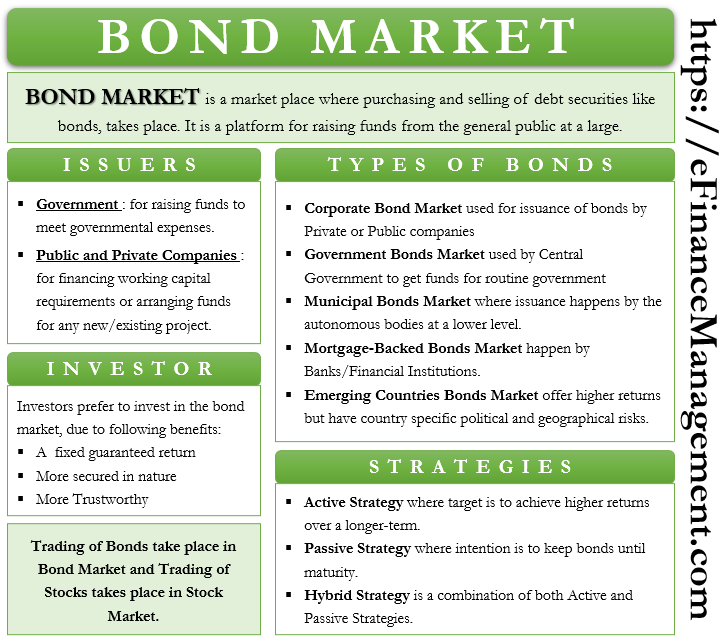

Bond Market Meaning Types Strategies Bond Indices And More Efm

Government Security Definition

What Are Government Bonds Learn About Bonds

Treasury Bills Guide To Understanding How T Bills Work

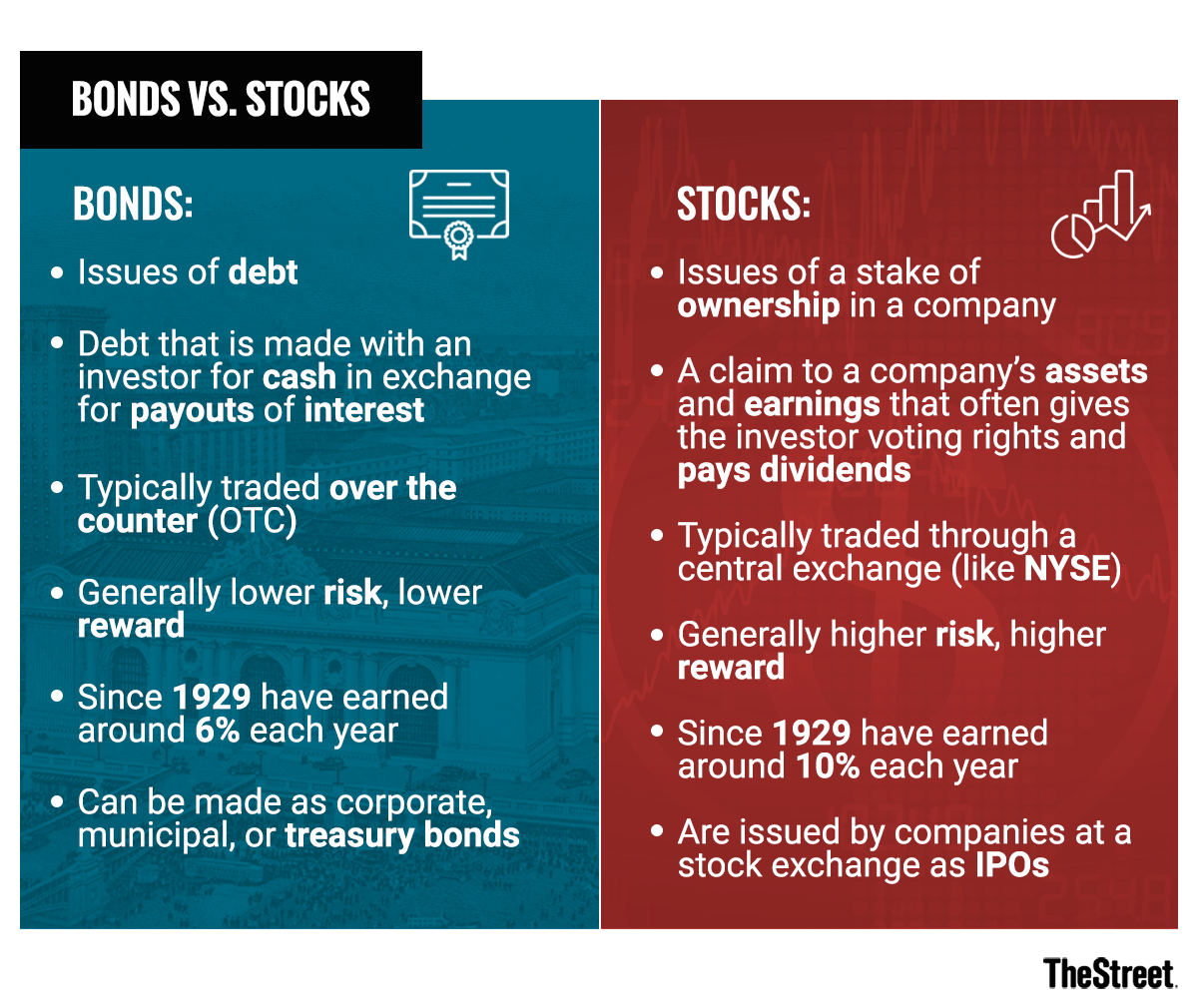

Bonds Vs Stocks What S The Difference Thestreet

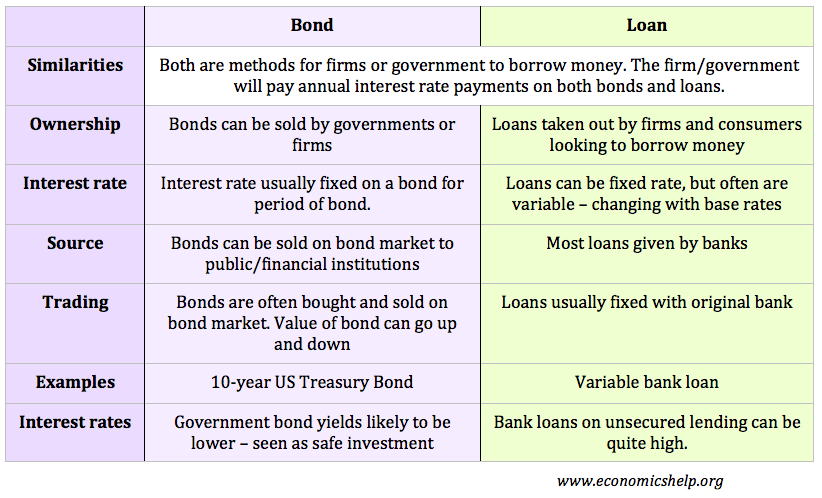

Difference Between Bonds And Loans Economics Help

Government Bonds Meaning Types Advantages Disadvantages Scripbox

Risk Free Rate Of Return Definition Example What Is Rf

/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

Bond Definition Understanding What A Bond Is

Post a Comment for "Definition Of Government Bonds"