Definition Of Variable Lease Payments

That process continues the same way although the amounts of CPI increases may change each year until something happens that requires a remeasurement of the lease such as exercising an option. A financial ratio that measures how much a company uses leasing arrangements to acquire its fixed assets.

3 3 Lease Classification Criteria

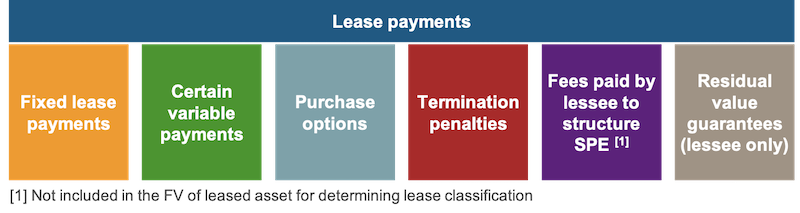

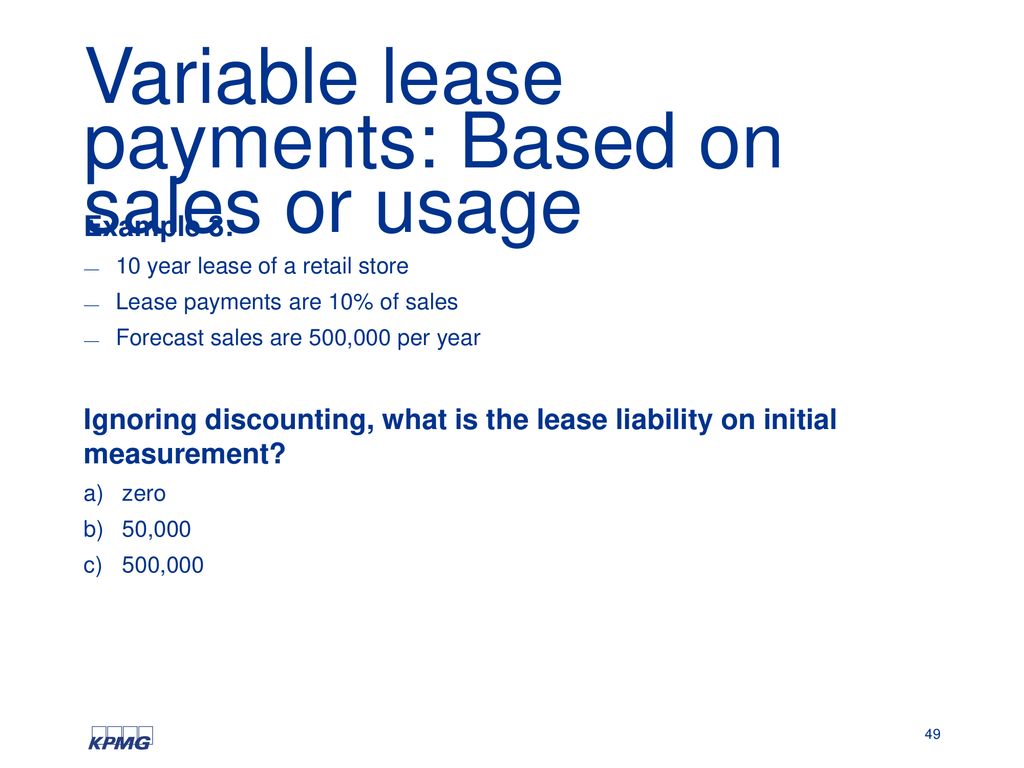

Variable lease payments that depend on sale or usage of the underlying asset see Section 41.

Definition of variable lease payments. There is a change in any of the following. Quantity produced by bearer plants There is no minimum output specified in the lease agreement. Lease payments that vary because of changes in facts and circumstances occurring after the commencement date other than the passage of time.

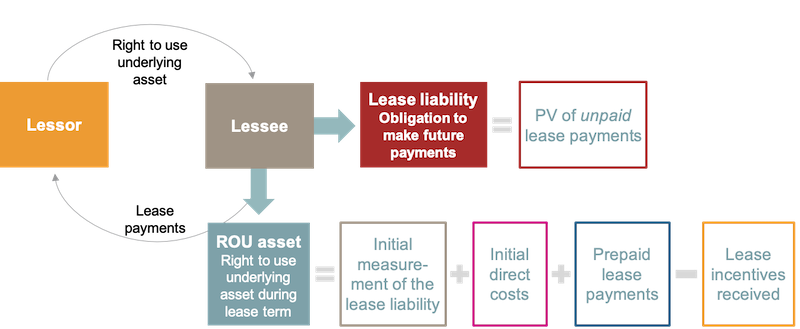

In contrast the following payments are excluded from the lease liability. Variable lease payments that depend on an index or rate are initially included in the lease liability using the index or rate at the commencement date of the lease. Only variable lease payments that depend on an index or a rate measured using the index or rate at lease commencement.

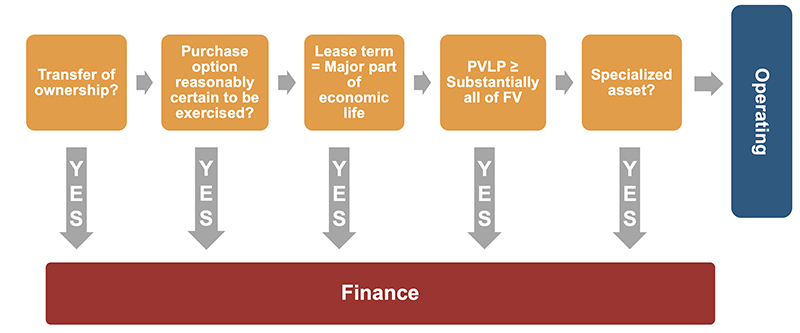

Variable Rent means for any calendar month or portion thereof during the Term the lesser of a 10 of Excess Oil Revenue for such month or portion thereof and b 28 of Base Rent ie 389 of Minimum Rent for such month or portion thereof12 Certain Interpretive ProvisionsAs used in this Lease. While finance leases can have variable payment features they have by definition a very high proportion of fixed rents. GAAP leases are finance leases if any of four conditions are met.

And payments for non-lease components unless the lessee elects to combine lease and non-lease components. Lease payments are variable based on the average CPO index for the month multiplied by FFB produced ie. The following table compares the requirements applicable to a lease if it is concluded that a rent.

The first category is payments that change based on an index or a rate such as the consumer price index or CPI or a benchmark interest rate such as LIBOR. Variable rents based on a rate e g. Instead they are recognized in profit or loss when incurred.

Variable lease payments depending on the future sales or use of the asset Well under the definitions in IFRS 16 the payments NOT depending on the rate or index DO NOT enter into your lease payments. That base rent of 10000 goes into the calculation of your ROU asset and liability and the CPI increases are treated separately as variable payments. Variable lease payments.

In other words they are excluded. The focus is on operating lease accounting for the lessee. The boards reaffirmed the requirement in the May 2013 ED that only variable lease payments that depend on an index or a rate should be included in the initial measurement of the lease assets and lease liabilities by using the level of the index or rate at lease commencement.

For example an event occurs that results in variable lease payments that were linked to the performance or use of the underlying asset becoming fixed payments for the remainder of the lease term. Variable lease payments are broken down into two categories. Variable lease payments are defined as the portion of payments made by a lessee to a lessor for the right to use an underlying asset during the lease term that varies because of a change in factors or circumstances occurring after the commencement date other than the passage of time.

Variable lease payments include payments linked to a consumer price index payments linked to a benchmark interest rate such as EURIBOR or payments that vary to reflect changes in market rental rates. Variable lease payments that are not included in the measurement of the lease liability are recognised in profit or loss in the period in which the event or condition that triggers payment occurs unless the costs are included in the carrying amount of another asset under another Standard. Sales are not booked unless intended as a tool to avoid capitalization also known as disguised minimum lease payments which will have to be.

Accounting for Variable Lease Payments Under current US. Variable lease payments not included in the measurement of the lease liability eg. A the word or is not exclusive and the words include includes and including are not limiting b references to a.

Utilization ratios come in two types which correspond with operating. Variable lease payments AASB 16Appendix A Variable lease payments are the portion of payments made by a lessee to a lessor for the right to use an underlying asset during the lease term that varies because of a change in factors or circumstances occurring after the commencement date other than the passage of time. The second category is all other changes such as.

Variable rents based on usage or lessee performance e. LIBOR or an index i e. CPI are booked based on spot rates.

On July 19 2021 the FASB issued ASU 2021-05 1 which requires a lessor to classify a lease with variable lease payments that do not depend on an index or rate hereafter referred to as variable payments as an operating lease on the commencement date. This publication was created for general information purposes and does not constitute professional advice on facts and circumstances specific to any person or entity.

Step 7 Lease Accounting Calculations

Https Www Pwc Com My En Assets Publications 2020 Mfrs16 Guide Variable Lease Payments Feb2020 Pdf

Ifrs 16 Leases Summary Example Entries And Disclosures

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Ifrs 16 Leases Ifrs 16 Leases The 3 Trillion Standard One Of My Great Ambitions Before I Die Is To Fly In An Aircraft That Is On An Airline S Balance Ppt Download

Ifrs 16 Leases Ifrs 16 Leases The 3 Trillion Standard One Of My Great Ambitions Before I Die Is To Fly In An Aircraft That Is On An Airline S Balance Ppt Download

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Asc 842 Classification And Accounting Treatment Of Lease Revgurus

Heads Up Frequently Asked Questions About The Fasb S New Leases Standard April 25 2017 Dart Deloitte Accounting Research Tool

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx)

Lease Accounting A Guide For Tech Companies Bdo Insights

How To Calculate The Present Value Of Lease Payments In Excel

Post a Comment for "Definition Of Variable Lease Payments"