Definition Of Yield Curve In Bonds

Typical Bond Yield Curve. Its a graphical representation of the yields available for bonds of equal credit quality and different maturity dates.

Bond Prices Rates And Yields Fidelity

Since long-term yields are characteristically higher than short-term yields a yield curve that confirms that expectation is described as positive.

Definition of yield curve in bonds. Every bond portfolio has different exposures to how the yield curve shifts --. Yield curve flattens 1Q 2004. The Treasury yield curve which is also known as the term structure of interest rates draws out a line chart to demonstrate a relationship between yields and maturities of on-the-run Treasury.

Short-term interest rates began to rise sharply 2006 or 2007. Federal Reserve BoardHaverAnalytics Strategy. A yield curve is a graph showing the relationship between the yield interest rates and how long before a debt or bond matures paid in full where the yield to maturity is on the vertical axis and the years to maturity is on the horizontal axis.

The Treasury yield curve for example graphs the yields of the three-month bill the. Borrow short and lend long Risk. The bond yield curve reflects the yield on government bonds depending on the maturity of the bond.

A yield curve is a way to measure bond investors feelings about risk and can have a tremendous impact on the returns you receive on your investments. A yield curve shows the relationship between the yields on short-term and long-term bonds of the same investment quality. A yield curve is a line that plots yields interest rates of bonds having equal credit quality but differing maturity dates.

A yield curve is a way to easily visualize this difference. We often refer to it as term structure of interest rates The curve reveals the relationship between the interest rate and the time to maturity of a security. The yield curve is a curve that plots the yields or interest rates for a certain debt contract with different maturity dates.

A yield curve shows the relationship between the yields on short-term and long-term bonds of the same investment quality. The comparison must be made between bonds of equal credit quality. F2653 Continue this exercise for all maturities and.

Since long-term yields are characteristically higher than short-term yields a yield curve that confirms that expectation is described as positive. For example suppose again the one-year bond is yielding 2 and the three-year bond was yielding 5 annual basis. Flat or inverted yield curve Yield Curve Shifts.

The slope of the yield curve gives an idea of future interest rate. In contrast a negative yield. Yield Curve 2004 to 2006 Rate 1Q 2006 1Q 2005 1Q 2004 Source.

Since long-term yields are characteristically higher than short-term yields a yield curve that confirms that expectation is described as positive. Bond Yield Curve Definition. A Recent Example of Flattening.

In contrast a negative yield. In contrast a negative yield. The yield curve is the graphical representation of that relationship in the market.

A yield curve is a chart of bond yields from the shortest-maturity issues to the longest-maturity ones. A yield curve shows the relationship between the yields on short-term and long-term bonds of the same investment quality. If an investor or analyst is good at predicting changes in the yield curve he or she will be able to benefit from the corresponding change in the prices of bonds.

Bond Market Meaning Types Strategies Bond Indices And More Finance Investing Accounting And Finance Marketing Strategy Business

/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-01-5a077058fc3d4291bed41cfdd054cadd.jpg)

The Predictive Powers Of The Bond Yield Curve

10 Year U S Treasury Bond Yield 2020 Statista

What Is A Financial Instrument Definition And Examples Market Business News Financial Instrument Financial Financial Markets

Bond Yield And Return Finra Org

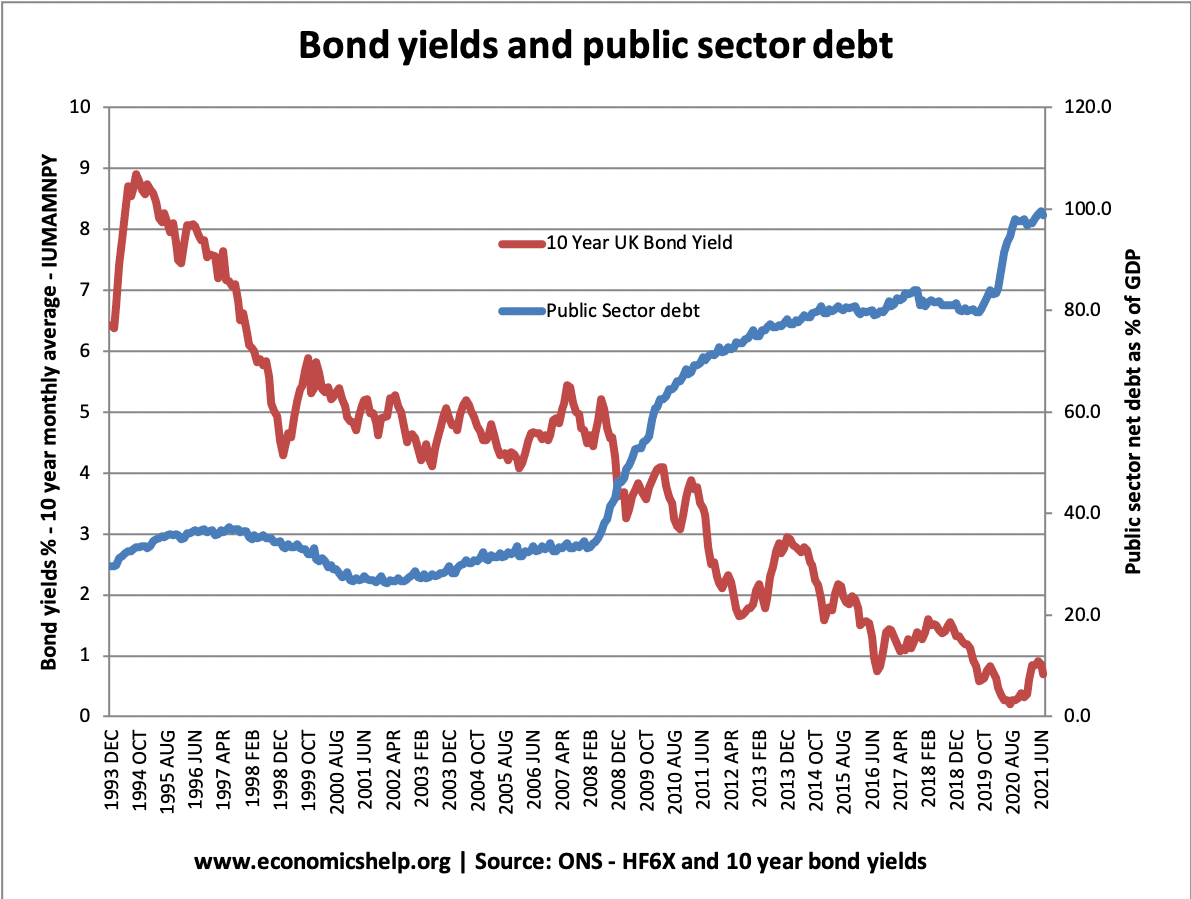

Does Higher Debt Lead To Higher Interest Rates Economics Help

/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-01-5a077058fc3d4291bed41cfdd054cadd.jpg)

The Predictive Powers Of The Bond Yield Curve

Understanding The Relationship Between Interest Rates And Bond Prices

Yield Curve Economics Britannica

Guide To Long Term Financing Definition Here We Discuss The Top 5 Sources Of Long Term Financing Along W Long Term Financing Finance Investing Project Finance

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Yield Curve What It Is And Why It Is So Important Yield Curve Finance Investing Accounting And Finance

Recession Watch What Is An Inverted Yield Curve And Why Does It Matter The Washington Post

Liquidity Premium In 2021 Accounting And Finance Finance Investing Financial Life Hacks

What Is The Yield Curve Definition And Examples Market Business News

Yield Curve Economics Britannica

:max_bytes(150000):strip_icc()/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

Post a Comment for "Definition Of Yield Curve In Bonds"