Definition Of Liquidity Risk

Is to promote the short-term resilience of the liquidity risk profile of banks. Liquidity risk The risk of having difficulty in liquidating an investment position without taking a significant discount from current market value.

Classification of the Liquidity of Fund Portfolio Investments.

Definition of liquidity risk. Liquidity risk is the potential that an entity will be unable to acquire the cash required to meet short or intermediate term obligations. An institution might lose liquidity if its credit rating falls it experiences sudden unexpected cash outflows or some other event causes counterparties to avoid trading with or lending to the institution. Definition of Liquidity risk Sandy Wickware Real Estate Agent Fathom Realty Risk that an individual may have to sell assets at distressed prices to raise funds.

Liquidity risk is defined as the risk that a fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining investors interests in the fund. In many cases capital is locked up in assets that are difficult to convert to cash when it is required to pay current bills. Liquidity risk is financial risk due to uncertain liquidity.

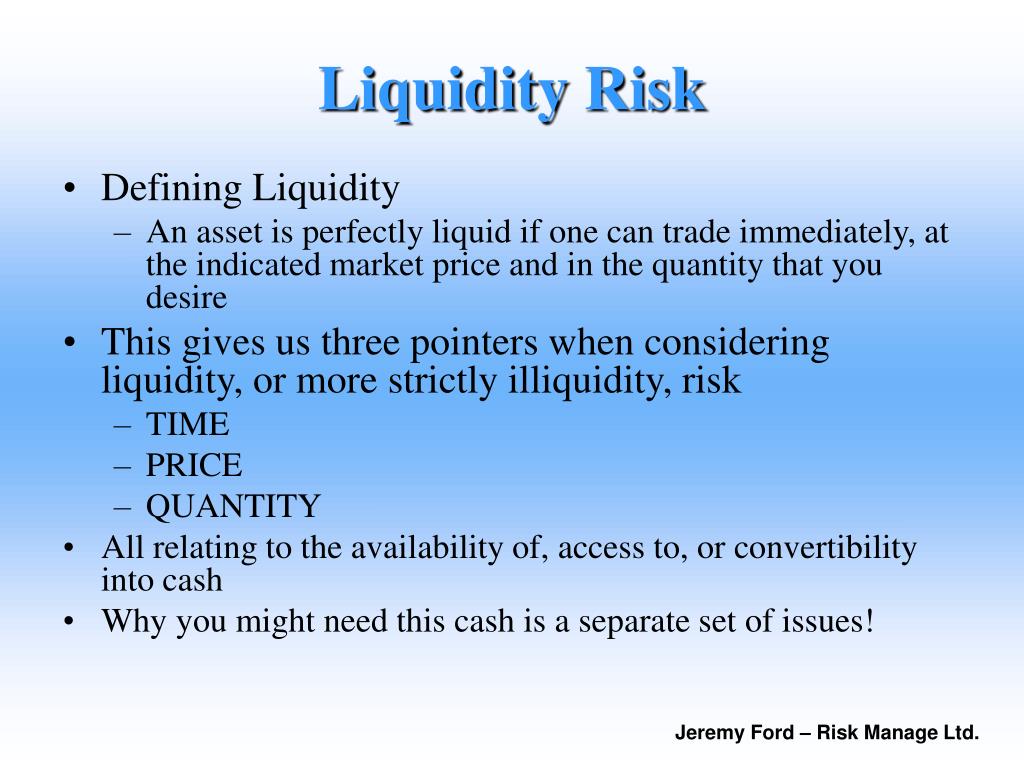

It is typically reflected in large price movements or uncommonly wide bid-ask spreads. An example is a homeowner who must sell his house at a low price because he cannot afford. There are two different types of liquidity risk.

Liquidity risk can have different meanings depending on how its used. What Does Liquidity Risk Mean. Liquidity risk can be a significant problem with certain lightly traded securities such as unlisted options and municipal bonds that were part of small issues.

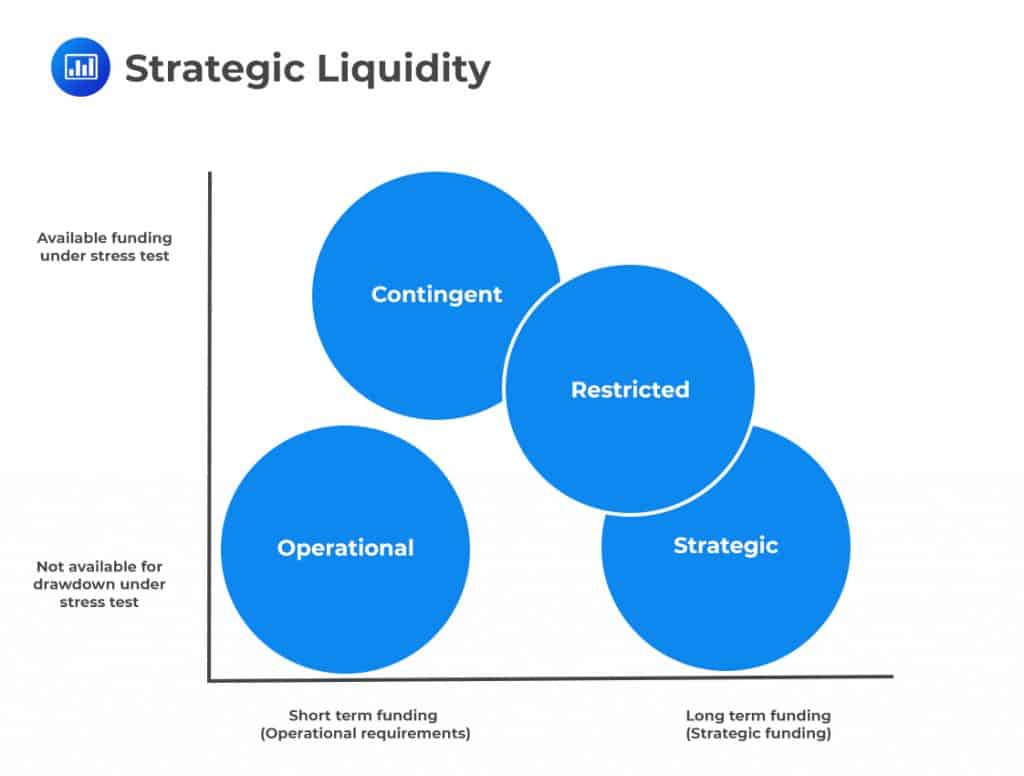

Using a unique data set consisting of all bids in the main refinancing operation auctions conducted at the ECB between June 2005 and October 2008 we find that funding liquidity risk is typically stable and low with occasional spikes especially around key events during the recent crisis. Thus funding liquidity risk is the risk that a firm will not be able to meet its current and future cash flow and collateral needs both expected and unexpected without materially affecting its daily operations or overall financial condition. What is the definition of liquidity risk.

Assets that are illiquid take more time to convert to cash and sell. Liquidity risk measures a companys or individuals ability to use assets to meet short-term financial obligations without incurring major losses. Also called marketability risk.

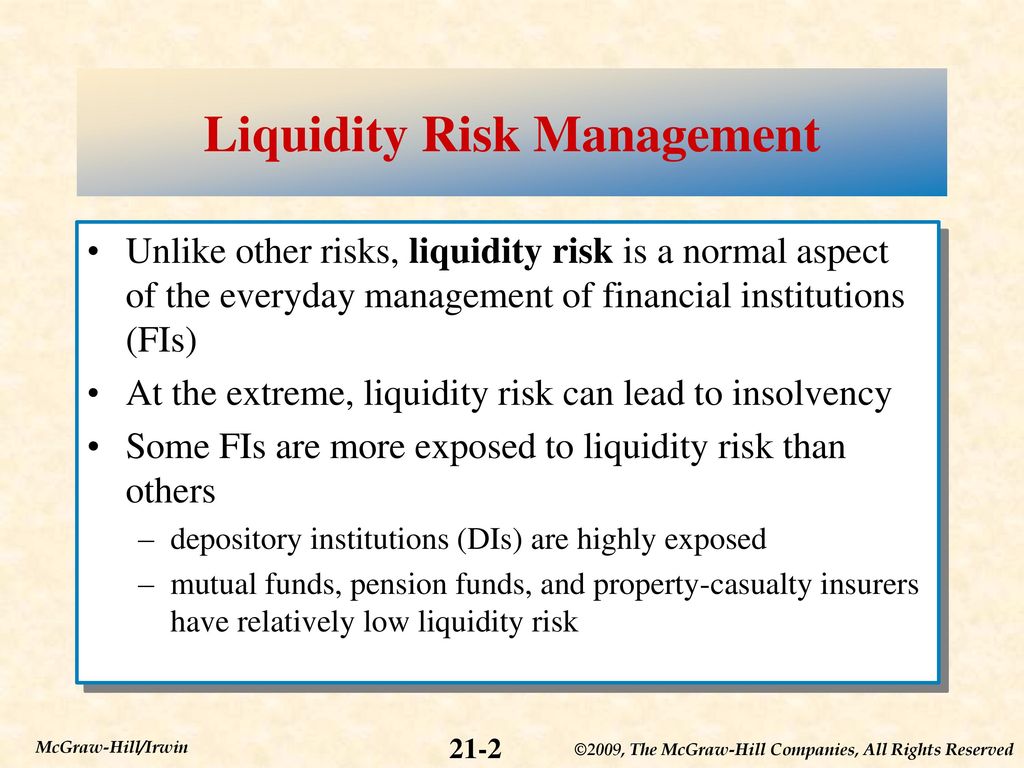

This usually occurs as a result of a firms inability to convert its current assets into cash without incurring capital losses. Prolonged exposure to liquidity risk could lead to the inability to meet short-term financial obligations which could increase the risk of. Funding or cash flow liquidity risk is the chief concern of a corporate treasurer who asks whether the.

From an investment perspective liquidity risk relates directly to how easy it is to buy or sell assets. The more liquid an asset is the easier it is to convert it to cash and find ready buyers. Liquidity Risk means Cash Crunch for a temporary or short-term period and such situations generally have an adverse effect on any Business and Profit making Organization.

To the extent that such conditions persist liquidity risk is endemic in the nancial system and can cause a vicious link between funding and market liquidity prompting systemic liquidity risk. The liquidity risk definition refers to the lack of marketability of a security or asset which cannot be sold or bought quickly enough to prevent or minimise a loss. It is exactly this type of market risk that typi-.

In the context of funding liquidity risk refers to the ability of institutions to fund liabilities as they fall due without incurring losses through being forced to sell less-liquid assets quickly. Liquidity risk is a firms possible inability to meet its short-term debt obligations thereby incurring exceptionally large losses. Unable to meet short-term Debt or short-term liabilities the business house ends up with negative working capital in most of the cases.

Funding liquidity and market liquidity risk. A market liquidity risk is a market risk due to the inability or difficulty in the selling of assets which in turn could drive down the market price. It does this by ensuring that banks have an adequate stock of unencumbered high-quality liquid assets HQLA that can be converted easily and immediately in private markets into cash to meet their liquidity needs for a 30 calendar day liquidity stress scenario.

Liquidity risk is the risk that pertains to the conversion of assets securities or bonds into cash without affecting their market price due to unfavorable economic conditions. It is a financial risk and may result in severe cash-crunch for investors in cases of assets like shares and bonds with high liquidity risk. An area of focus for post-crisis regulation of banks has been addressing mismatches between the liquidity of banks assets and liabilities.

Bafin Expert Articles Investment Funds Dealing With Liquidity Risks

Ppt Liquidity Risk Powerpoint Presentation Free Download Id 4223053

Market Liquidity Explained Why Is Liquidity Important Ig En

Chapter Twenty One Managing Liquidity Risk On The Balance Sheet Ppt Download

Liquidity Stress Testing Cfa Frm And Actuarial Exams Study Notes

Liquidity Risk Definition And Meaning Capital Com

1 Topic 6 Measuring Liquidity Risk 6 1 Definition Of Liquidity Risk 6 2liquidity Risk At Depository Institutions Dis 6 3 Measurement Of Liquidity Risk Ppt Download

Financial Risk Types Of Financial Risk Advantages And Disadvantages

Liquidity Risk Definition And Meaning Capital Com

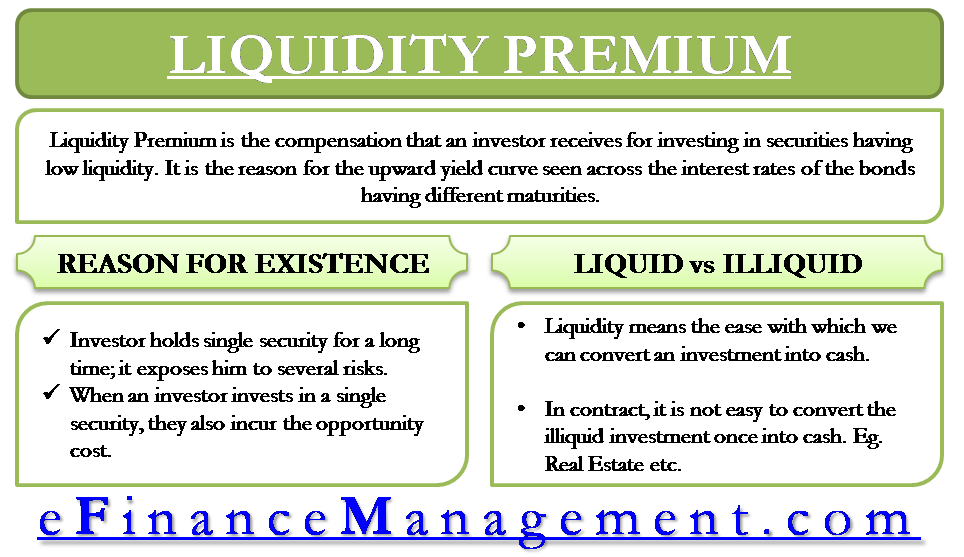

Liquidity Premium Meaning Liquid Vs Illiquid Investments Efm

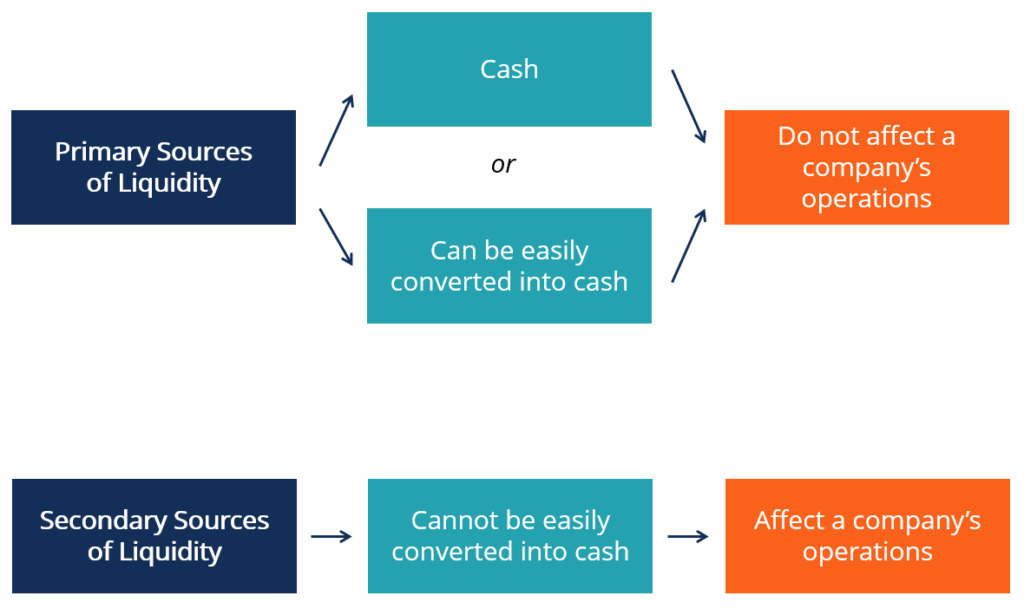

Sources Of Liquidity Overview Primary And Secondary Sources

Liquidity Risk Cost To Close Liquidity Gap Financetrainingcourse Com

Https Www Ecb Europa Eu Pub Conferences Shared Pdf 20181106 Money Market Workshop 2018 Mmworkshop Wrampelmeyer Presentation Liquidity Risk Funding Cost Pdf

Liquidity Risk Meaning Reasons Types Measures Ratios Control Efm

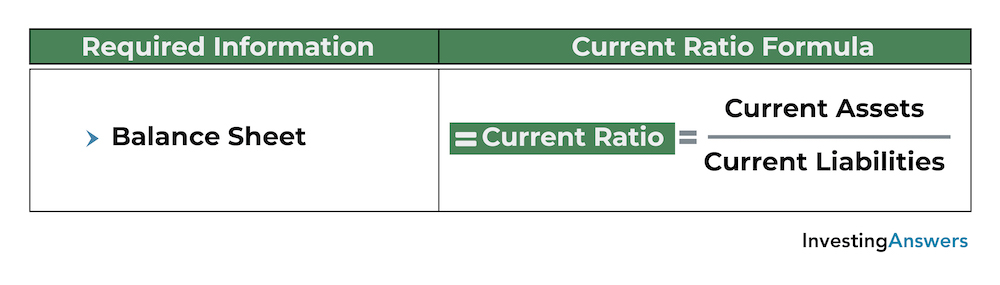

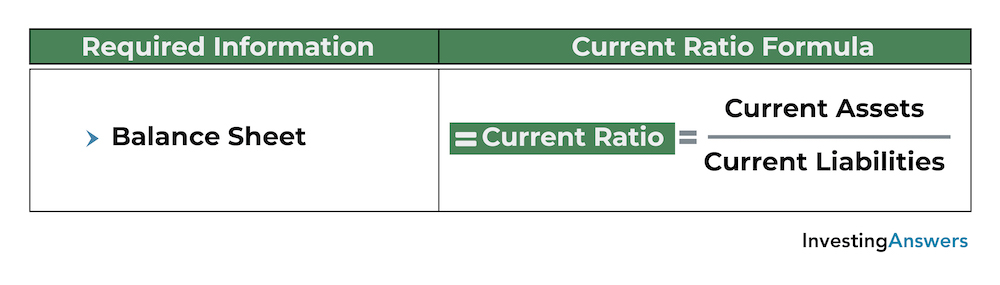

Liquidity Risk Definition Example Investinganswers

Liquidity Risk Definition And Meaning Capital Com

Https Www Ecb Europa Eu Pub Conferences Shared Pdf 20181106 Money Market Workshop 2018 Mmworkshop Wrampelmeyer Presentation Liquidity Risk Funding Cost Pdf

Liquidity Risk Definition Example Investinganswers

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Post a Comment for "Definition Of Liquidity Risk"